The Arizona State Retirement System (ASRS) provides retirement income for nearly 150,000 former teachers, state workers, and civilian municipal employees across the Cactus State. The guaranteed income provided to retirees is based on their final average salary and years of service while working in public service. While this is a welcome benefit for Arizona’s public servants, over the past two decades, the cost has been spiraling out of control.

Back at the turn of the century, the total required contribution rates for the state’s pension plan were around 4% of everyone’s pay. This fiscal year, the required contributions to pre-fund promised pensions are more than 23% of total salaries. In ASRS employers and employees split the costs equally, meaning that an increase in total contributions means dollars are being diverted from the paychecks of teachers and other public workers.

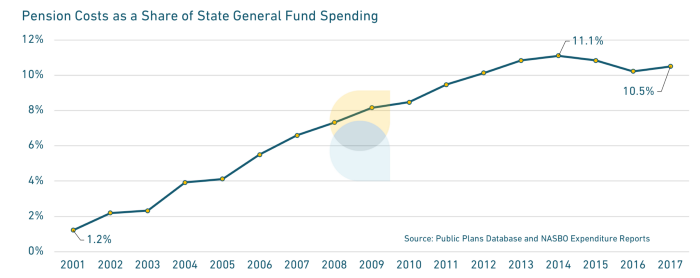

As can be seen in the chart at the top, the growth in contributions paid for ASRS has taken up more and more of the general fund dollars Arizona lawmakers use to keep the state running. The expansion of pension costs is plain to see. Contributions comprised roughly 1% of general fund spending in 2001 but have increased nearly ten-fold to 10.5% in 2017.

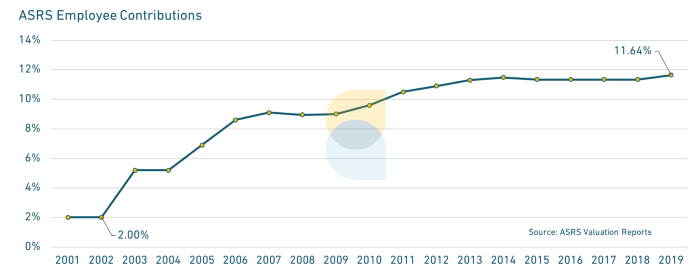

At the same time, because of the funding policy requiring employees cover 50% of all costs, the growth in total contributions has more than quadrupled since 2002 (which was the last year that ASRS was 100% funded). The chart below shows the historic trend of how much Arizona’s teachers, state workers, and civilian municipal employees have had to pay each year into the pension plan.

Click here for a chart showing total historic contributions.

Over the course of the past two years America has seen a number of teacher strikes across the country — first in West Virginia, followed by similar protests in Oklahoma, Kentucky, and Colorado. Earlier this year in both Los Angeles and Denver authorized strikes. And of course, Arizona’s teacher strikes took center stage in the pursuit of growing teacher compensation (which has been stagnant for much of the last decade). The political shift this year has led more than 20 governors to state this year that teachers have long deserved a raise.

Yet, while the attention on teacher pay is well warranted, the dangers posed by growing pension costs require a broader discussion about total compensation.

Equable has commissioned research from a number of organizations to examine why Arizona has struggled with its pension costs, what the consequences have been, and what options are available to improve sustainability of ASRS and its ability to deliver retirement security. Over the next few days we will be highlighting some of that research as it is published.

To learn more about how ASRS benefit works, see this information page and pension calculator tool we developed to provide more educational resources.

To see a topline review the of the financial health of ASRS, download this PDF overview for key information.

This article was originally published on our Medium blog on May 14, 2019.