Pension funds lose assets in a market downturn[1]

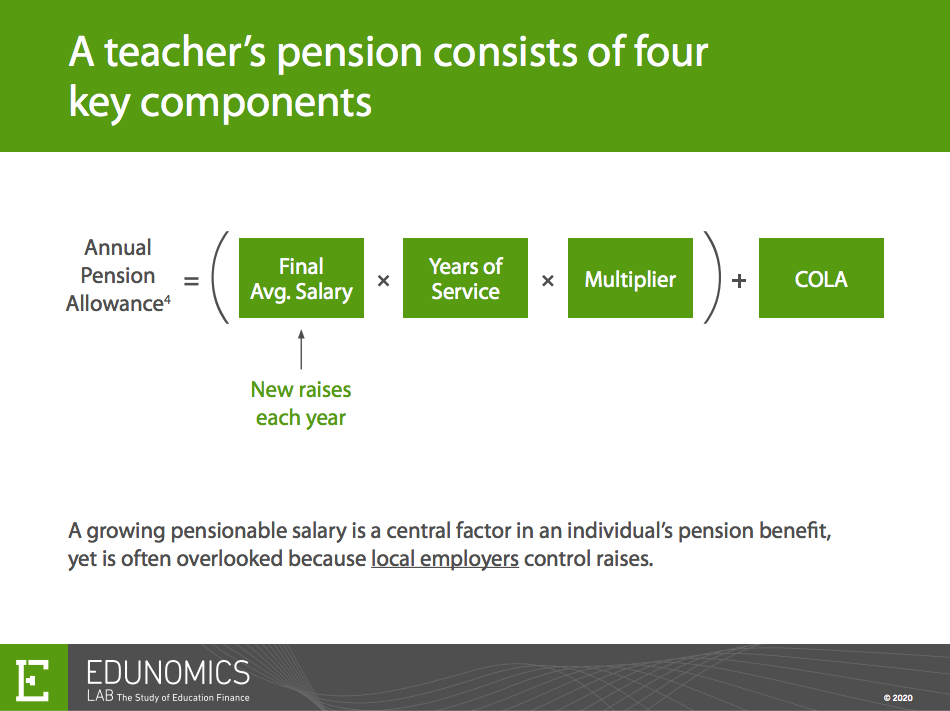

Due to the nature of defined benefit plans, the system still needs to pay full retiree benefits, even when return on assets plummets in an economic downturn. School systems have committed to pay raises, even though they are no longer in sync with the labor market. Those raises drive up teacher retirement costs at a time when the broader population sees declines in their retirement assets.

As the US enters an economic downturn, public pension systems will be further stressed, and states will have difficulty making full payments to their funds.[2]

Policymakers seeking ways to regain control of burdensome pension debt

Types of changes typically sought:[3]

- Increases in employee contributions

- Cost of living adjustment (COLA) reductions

- Increase in retirement age and/or vesting periods

- Change to final average salary (cap final salary and/or years averaged in formula)

Policymakers still feel limited by their means to lower pension costs for teachers already in the system without putting a larger share of the burden on younger teachers. But many are overlooking an important lever still under their control – pensionable pay raises.

Imagine if lawmakers passed a law: (1) All raises during near-term shortfalls (recessionary times) are non-pensionable – OR – (2) All raises going forward are non-pensionable until pension debt is fully funded

- Pensions on current salaries are protected.

- Teachers still earn years of service.

- Assumes all teachers made whole in salary with non-pensionable pay.

- Assumes teachers don’t have to pay retirement contributions on non-pensionable pay.

- Employers can give raises, but not pensionable ones.

- Employers could offer retirement on non-pensionable salary, but it would be subject to ERISA.

This study examines both the two-year impact and the ten-year impact if such a law were enacted in 2008:

- What would this mean for teachers? We explore three different teachers at different longevity levels

- How would such a requirement affect pension debt?

- Is this a viable (legal) policy option?

This analysis explores the effect across California, Illinois, Texas, and Vermont.

Read the full policy brief here.

_______________

This article republishes selections from “Could states save money if raises during a recession were designated as non-pensionable?,” a policy brief from the Edunomics Lab at Georgetown University in May 2020. The whole policy brief is available here. Equable Institute provided funding for the development of this research.

Footnotes

[1] Fensterwald, J. (2014, July 14). CalSTRS reports a big year of earnings. Retrieved from:

https://edsource.org/2014/calstrs-reports-big-year-of-earnings/65421

[2] Brown, A. (2020, January 31). Reforms May Be the Downfall of Pension Funds. Retrieved from:

https://www.bloomberg.com/opinion/articles/2020-01-31/pension-funds-may-not-survive-a-recession

[3] Aubry, J. and C. Crawford (2017). “State and Local Pension Reform Since the Financial Crisis.” 54. Chestnut Hill, MA: Center for Retirement Research at Boston College. https://crr.bc.edu/wpcontent/uploads/2016/12/slp_54.pdf