Who Benefits?

How Connecticut's Financing of Teacher Pensions Reinforces Inequity in the Classroom (Second Edition, 2023 Data)

The State of Connecticut is subsidizing school districts by directly paying for all costs of teacher pensions. This Per Pupil Pension Subsidy allocates more dollars to higher performing, more affluent, and less diverse districts and puts districts with the greatest need at a systemic disadvantage in terms of resource equity and how they compensate their teaching workforce.

TEACHER AND STAFF SALARIES ARE UNEQUALLY DISTRIBUTED ACROSS CONNECTICUT SCHOOL DISTRICTS

Salary is a significant component of calculating a pension benefit, so it is important to understand the distribution of salaries across Connecticut in order to appreciate what is driving the state’s Per Pupil Pension Subsidy. Districts do set their own salary schedules, and as the maps below show, the distribution of salaries are far from equal.

PENSION SUBSIDY DOLLARS ARE UNEQUALLY DISTRIBUTED ACROSS CONNECTICUT SCHOOL DISTRICTS

Public school districts have different per pupil pension costs because of variability in pensionable salaries, the number of teachers serving and their longevity, and student enrollment levels. By looking at each public school district’s pension obligations, and dividing them by student enrollment figures, we can determine how much the state spends per student in each public school district when it makes an annual contribution to the Teacher Retirement System. We call this equity metric the Per Pupil Pension Subsidy.

The table below shows the 25 largest school districts in Connecticut by enrollment, organized by the size of their Per Pupil Pension Subsidy and adding salary band data. This shows a clear pattern that districts with higher pension subsidies have largest shares of highly paid teachers and staff.

KEY FINDINGS ABOUT PER PUPIL PENSION SUBSIDIES

FINDING 1:

Connecticut pays Per Pupil Pension Subsidies at less than half the rate for students from low-income families as compared to their peers.

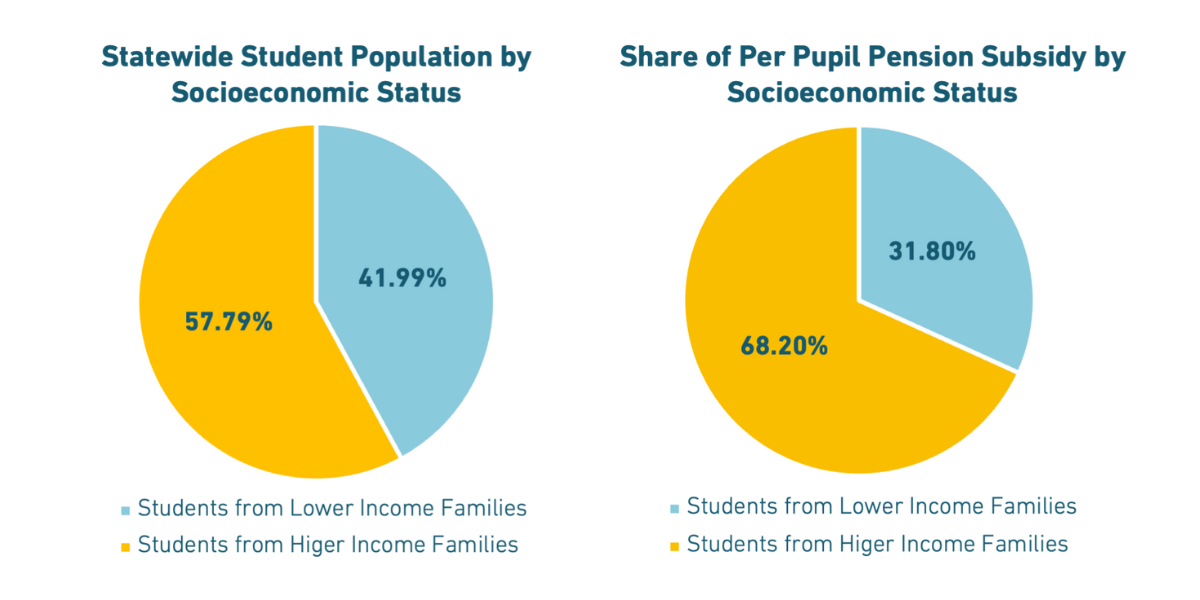

Across Connecticut, students from low-income families make up 42% of the total population; but these students are only allocated 31.8% of the state’s Per Pupil Pension Subsidy. The subsidy dollars flowing to higher income areas mean wealthier students receive 68.2% of these dollars—more than double the allocation for their low-income peers.

FINDING 2:

Connecticut pays Per Pupil Pension Subsidies at less than half the rate for students from low-income families as compared to their peers.

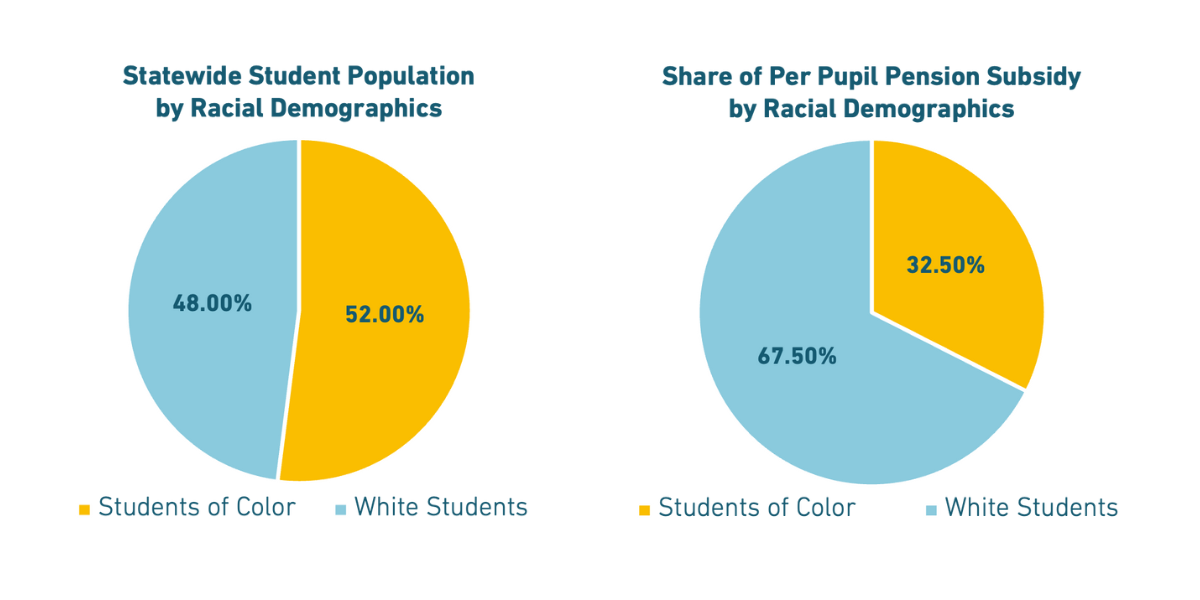

White students make up 48% of the student population in Connecticut, but are allocated a 68% share of the state’s Per Pupil Pension Subsidy—more than double the allocation for their non-white peers. Although students of color make up 52% of the student population in the state, they receive only a 32.5% share. Black students make up 12% of the student population, but receive only a 7% share. Hispanic students, who make up 30% of the population, receive only a 17% share.

FINDING 3:

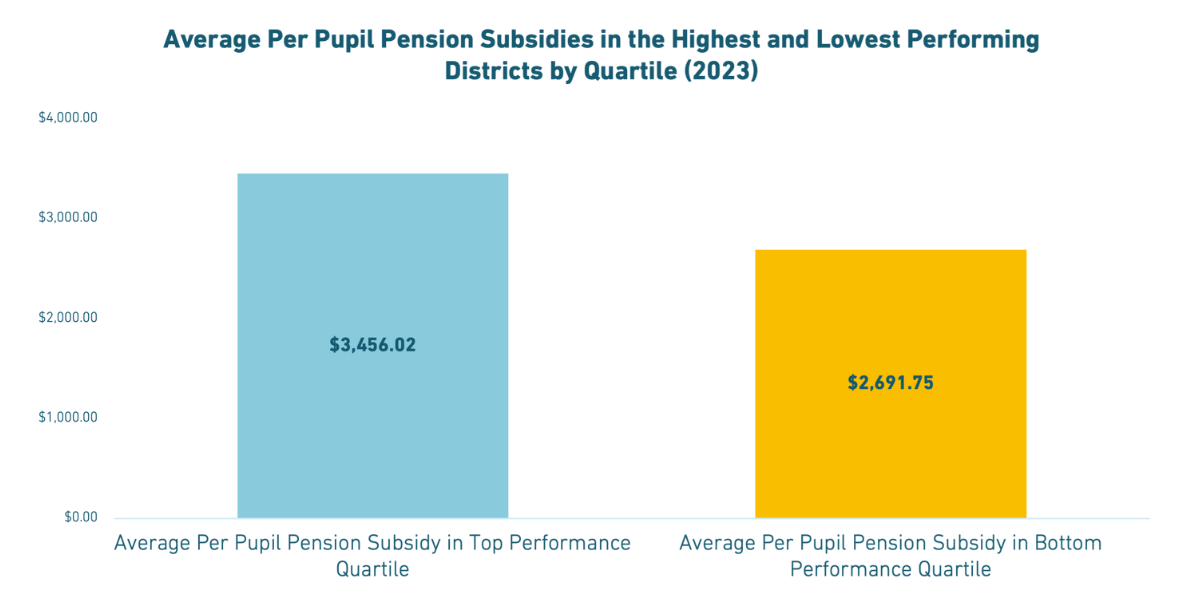

Connecticut pays a 28% larger Per Pupil Pension Subsidy on behalf of teachers in high-performing districts than for districts with lower performance.

The average Per Pupil Pension Subsidy for the highest performers in the state is $3,456, as compared to an average subsidy of only $2,692 among the lowest performing districts. This means that, on average, the highest performing districts are getting 28% more per student subsidies from the state to support teacher compensation and there is a down stream effect on students’ educational experiences because of its implications for districts’ abilities to attract and retain a stable, high-quality teacher workforce.

WHAT CAN BE DONE ABOUT THIS?

In 2023, the Connecticut legislature recognized the need to address this injustice when it authorized a task force to analyze the per pupil equity of funding the teachers' retirement system. Unfortunately, this body never fully formed to explore an appropriate policy response—allowing an inequitable distribution of Per Pupil Pension Subsidies to persist.

Connecticut students still need state and legislative leadership to enact a viable solution to funding teacher pensions so that districts can fairly recruit, retain, and support their educators with the retirement benefits they need.

If state policymakers want to adopt an equity lens when designing a policy by which towns pay for a portion of their pension costs, then an appropriate response would begin with these four foundational principles:

1. Retirement benefits are a form of compensation.

2. The state should cover any accumulated unfunded liability costs that might be required.

3. The highest-need districts should be protected from budget increases.

4. This policy solution must be phased in.

Read the paper for more thoughts on how to concretely apply these principles in developing a policy solution.