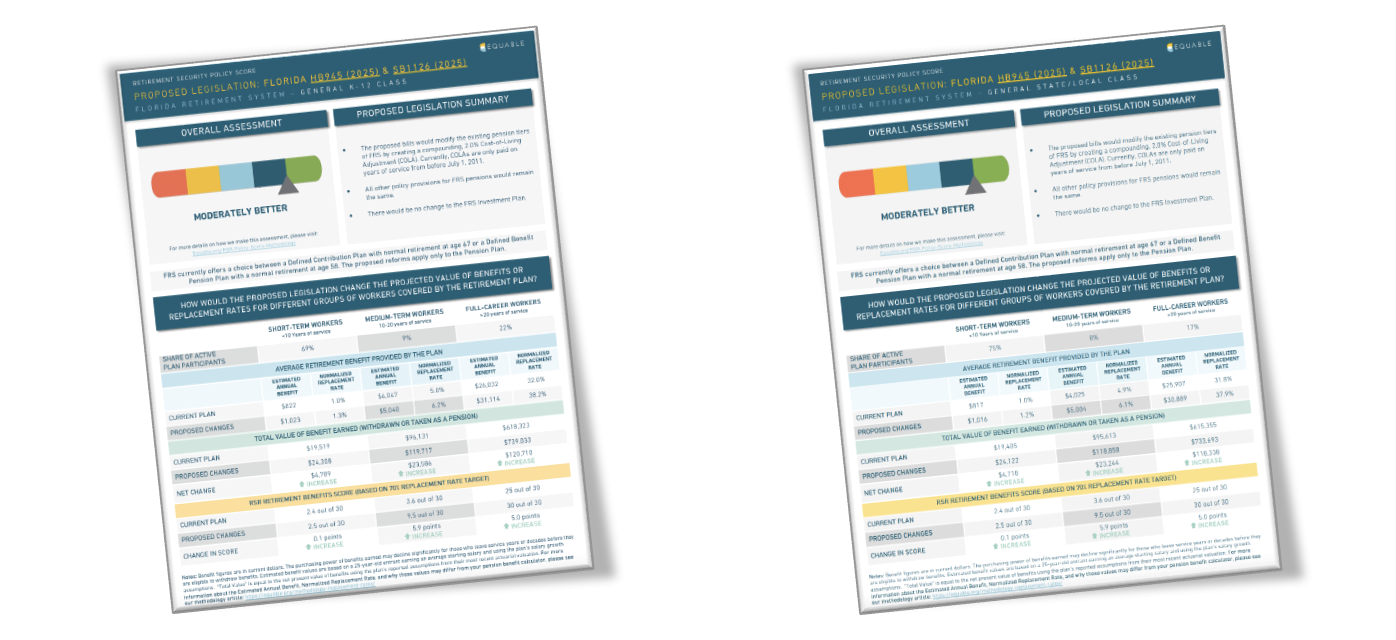

Equable Institute has issued a Retirement Security Policy Scorecards for Florida House Bill 945 and Senate Bill 1126. The bills would modify the existing pension tiers of Florida Retirement System (FRS) by creating a compounding, 2.0% Cost-of-Living Adjustment (COLA). Currently, COLAs are only paid on years of service from before July 1, 2011. Equable’s assessment of the proposed plan’s provisions finds that retirement benefits would be moderately better overall for workers under this bill, as currently drafted.

According to the assessment, workers of all tenures will experience an increase in the overall value of their retirement benefits, with full-career employees (those with more than 20 years of service) experiencing the most significant gains in value. The average full-career worker enrolled in FRS will experience an increase of $118,338 in the total lifetime value of their retirement benefits under the proposed legislation.

To illuminate the impact on different workers across the state, Equable has produced two scorecards for this bill: one for educators and other K-12 employees, and one for general employees.

DOWNLOAD THE TEACHER SCORECARD

DOWNLOAD THE GENERAL SCORECARD

EQUABLE INSTITUTE’S ANALYSIS OF FLORIDA SENATE BILL 945 & HOUSE BILL 1126

Positive Elements of Florida House Bill 945 and Senate Bill 1126:

- The proposed bills would improve the benefit offerings to active and retired members of the FRS pension plan by providing them all with a COLA. This will help to protect benefits from inflation and can allow members to enjoy their retirement benefits without them being eroded over time.

- The addition of the COLA for Tier 2 members would result in an increase in the estimated annual benefits and total benefits for all worker profiles. Short-Term Workers would see their total benefits increase by roughly $4,700, Medium-Term Workers would see benefits raised by more than $23,000, and Full-Career Workers would have their benefits grow by over $115,000.

Negative Elements of Florida House Bill 945 and Senate Bill 1126:

- FRS currently has almost $35 billion in unfunded liabilities and these proposals could increase that if the new COLAs are not pre-funded.

- Any benefit enhancement comes with a cost. As of this publication, there have not been any actuarial analyses published by FRS, the legislature, or a consulting actuary. It is not clear how much the addition of the COLA would cost FRS members, employers, and taxpayers. However, the legislature should consider if it would be better for participants if that same cost was instead used to pay down unfunded liabilities faster before completely restoring the COLA.

- COLAs are a benefit for those members who remain in their jobs for a full career or for long enough that they will claim a pension. This means that this benefit enhancement will only really provide a significant improvement to the roughly 25% of members that are expected to work for more than 10 years.