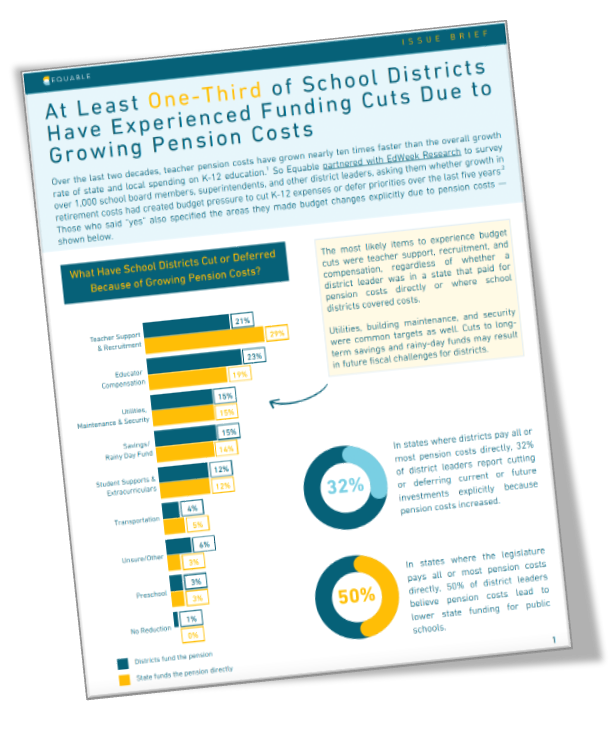

The latest issue brief from Equable Institute reveals that rising teacher retirement costs driven by pension debt are placing significant financial pressure on K–12 school districts across the country—resulting in cuts to educator compensation, support services, long-term savings, and more.

The analysis, based on a survey of over 1,000 school district leaders and board members nationwide, finds that at least one-third of school districts have cut or deferred spending due to rising pension costs over the past five years. In states where legislatures pay pension costs directly, half of school leaders believe those expenses have led to lower state funding for public education.

Download the Issue Brief

The brief also highlights that how pension costs are shared between states and districts significantly shapes how local districts are impacted by rising costs.

To help states better address these challenges. Equable has also issued a set of policy recommendations and assessment of existing state-specific policy. Read it here.