Guaranteed lifetime income is one of the best things that come with having a pension plan.

But pensions aren’t the only financial route to guaranteed lifetime income after you retire. Uniquely, states calculate post-retirement income via a pension formula.[1]

The pension formula is based on your working years, both how long you serve and what you earn. In this article we will explain how you can calculate or estimate the value of your future pension. We also have a calculator that you can use to estimate your future pension if you are in a pension plan currently accepting new members.

The Formula, Explained

Here are three key concepts that are important for calculating the value of your pension:

- Years of Service (YOS): This is how many qualifying years you’ve worked for your employer within the pension plan.

- Final Average Salary (FAS): This is compensation that your pension will be based on. For most state and local pension plans the final average salary is based on the last three or five years of work. Some states use the three or five highest years of salary. So this is also known as final average compensation, or final average pay, or even highest average salary.

- Multiplier or Accrual Rate: This is a percentage number that states have predetermined in statutes and can vary by state and hire date. You “multiply” this percentage against your years of service to create larger pension benefit values.

Pension plans calculate years of service and what determines final average pay using different rules. Those rules can make a big difference in how much a pension is worth.

Notably, the contributions paid by pension plan members do NOT factor into the value or their pension. The money contributed by employers and pension plan members matters for building up assets that can pay promised benefits, but the benefit amount paid is only based on the pension formula. (For more about how pension formulas work, read this.)

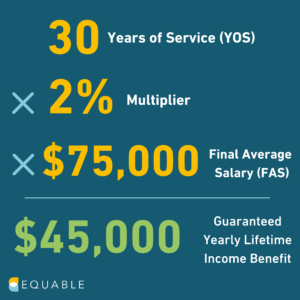

Here is a way to visualize how pension formulas work:

You will use he “multiplier” in the formula determine the percentage of your final average salary that you will receive as a retirement benefit. You then multiply your years of service using this specific number. That amount becomes a percentage of your final average salary. And the result equals the amount you’ll ultimately receive as a benefit when you retire. The higher the multiplier, the larger the benefit. Other names used for multipliers are “accrual rate” or “crediting rate,” but they mean the same thing.

A Typical Example:

That $45,000 becomes your guaranteed lifetime annual income.

An important way to think about the formula: in this example the result of 30 years of service is a pension that is worth 60% of the final average salary. The 30 years are multiplied by the 2% multiplier, and that is equal to the 60% replacement rate.

Calculate Your Pension

Below is a pension calculator that can be used to estimate the value of your future pension, taking into account various factors and scenarios. There are hundreds of public pension plans and we are gradually adding to the list of those in this calculator. If you do not see your pension plan listed here, please contact us and we’ll be sure to add it quickly and send you notes estimating your pension.