Oklahoma is considering changes to retirement plan provisions for its Public Employees Retirement System (OPERS), as presented in House Bill 2486 (HB2486). The stated intent of the legislation is to help improve the government’s ability to recruit public employees.[1] The state House adopted HB2486 on March 28, 2022. A committee in the state Senate amended HB2486 on April 4, 2022.

Equable Institute has analyzed the proposed changes by both the Oklahoma House and Senate using our Retirement Security Report methodology. We have published scorecards for each version of HB2486 that compares the how the proposed changes to retirement benefits would influence current and/or future OPERS plan members. The scorecards can be downloaded at the links below. Scroll down in the article for our complete analysis of the benefit provisions of the proposed legislation.

DOWNLOAD THE HOUSE SCORECARD | EXTENDED HOUSE SCORECARD

DOWNLOAD THE SENATE SCORECARD | EXTENDED SENATE SCORECARD

KEY POLICY CHANGES IN HB2486:

House version:

- The legacy defined benefit pension plan that OPERS manages for members hired before November 2015 would be re-opened for all current members and new OPERS members (the legacy pension plan was closed by the legislature to new hires back in 2015).

- Anyone enrolled in the OPERS defined contribution plan would have their individual account balances closed and be converted into pension plan members.

- The Senate amended version of HB2486 would keep open the OPERS defined contribution plan and increase employer contribution rates.

- The minimum employer rate would rise from 6% of salary to 8%.

- When members themselves make contributions above 7% of salary, this triggers and employer match. The employer match on member contributions would jump from 7% of salary to 10%.

WHAT HOUSE BILL 2486 MEANS FOR WORKERS:

House: OPERS members would be no longer be offered a defined contribution plan and instead be enrolled in a defined benefit pension plan with lower overall benefits, but guaranteed income.

Senate: OPERS members would be offed a defined contribution plan that serves all members well, on average. There would be no option to select a pension instead.

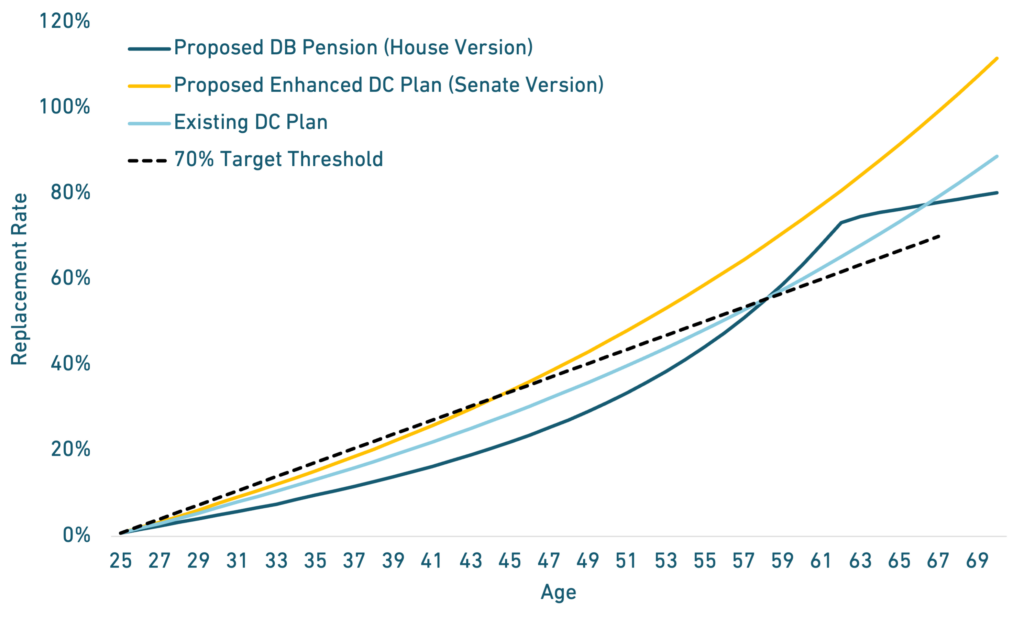

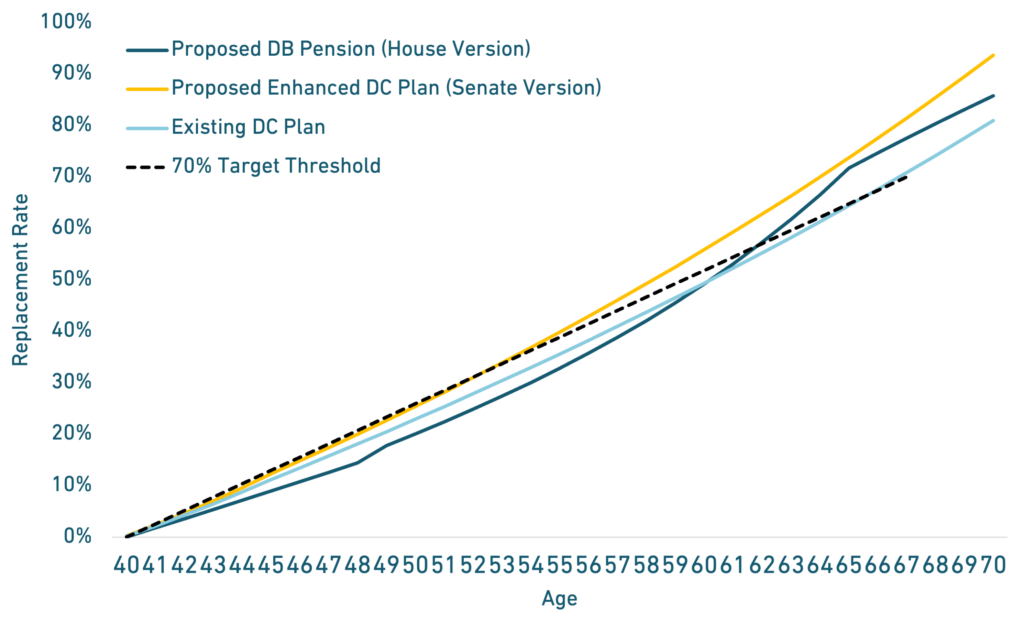

We use a Benefits Score methodology that measures the future income value of retirement plans and compares this to a 70% “replacement rate” income adequacy threshold.

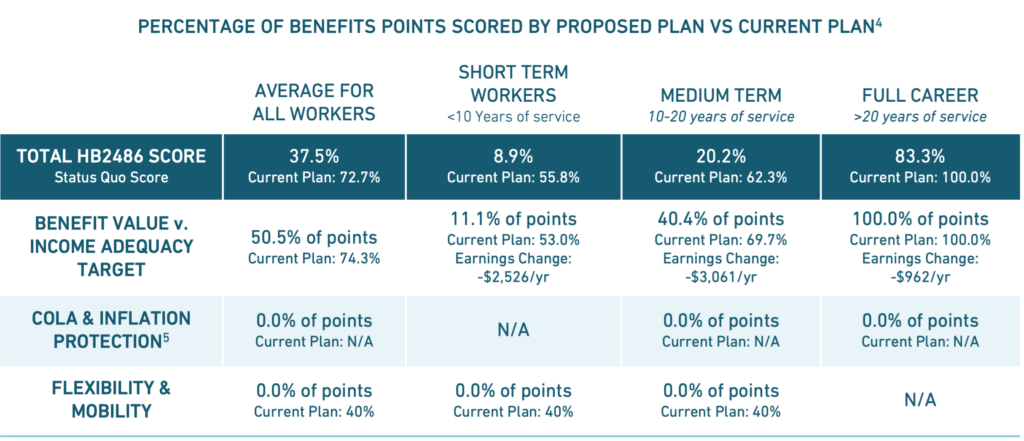

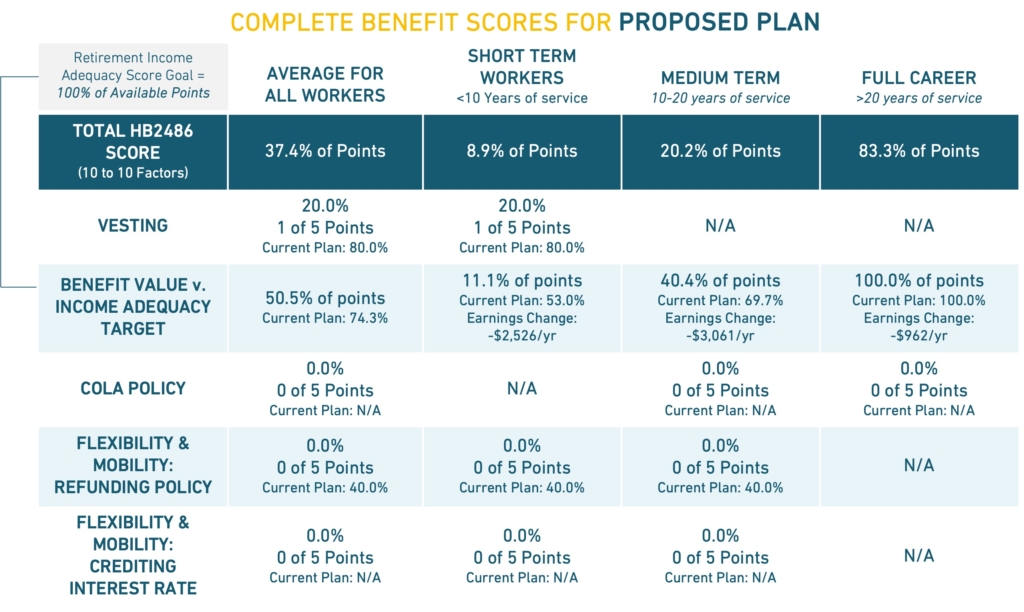

House Version

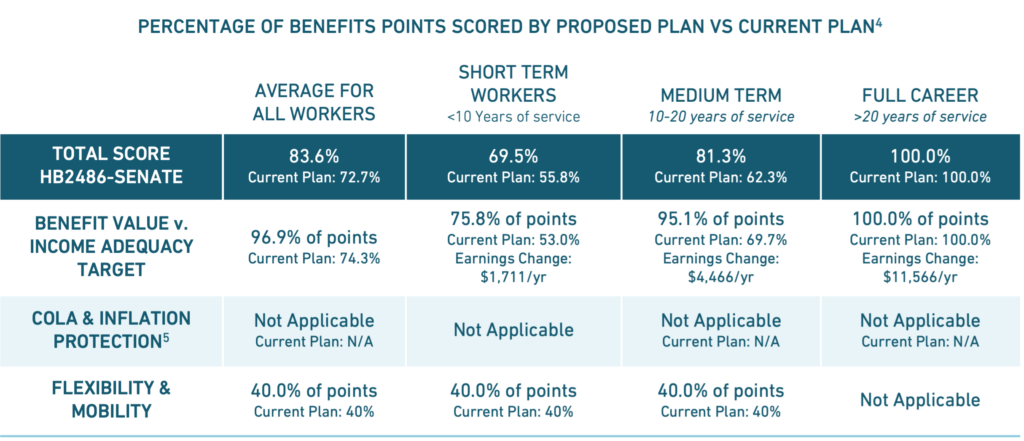

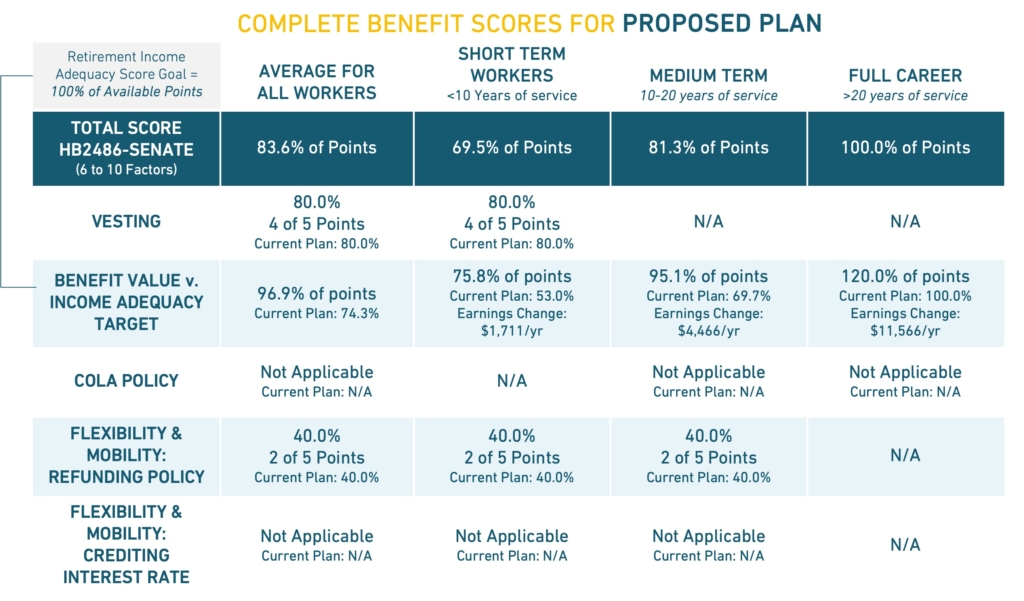

Senate Version

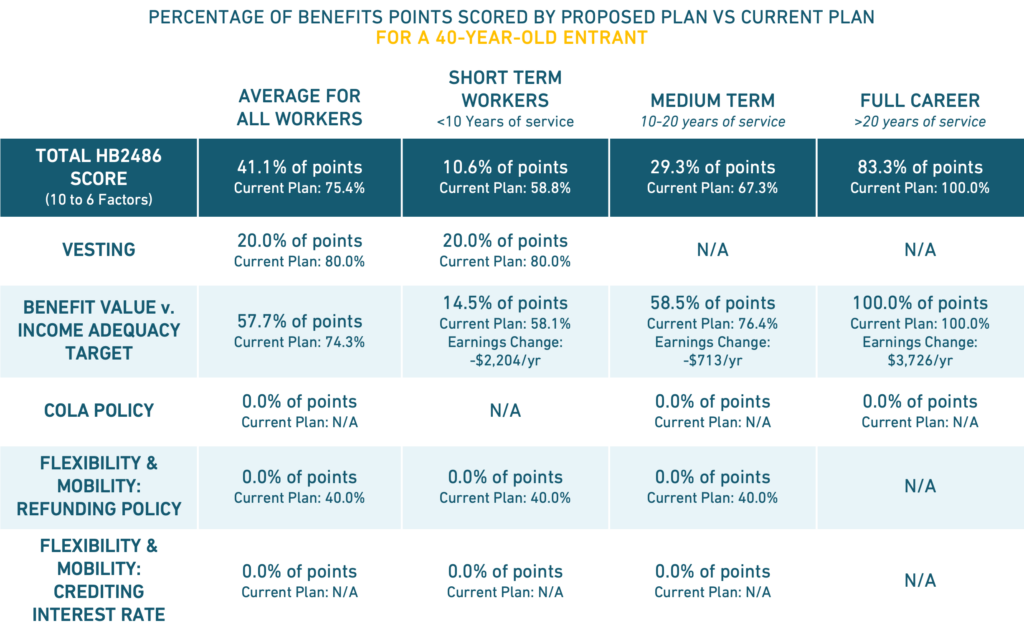

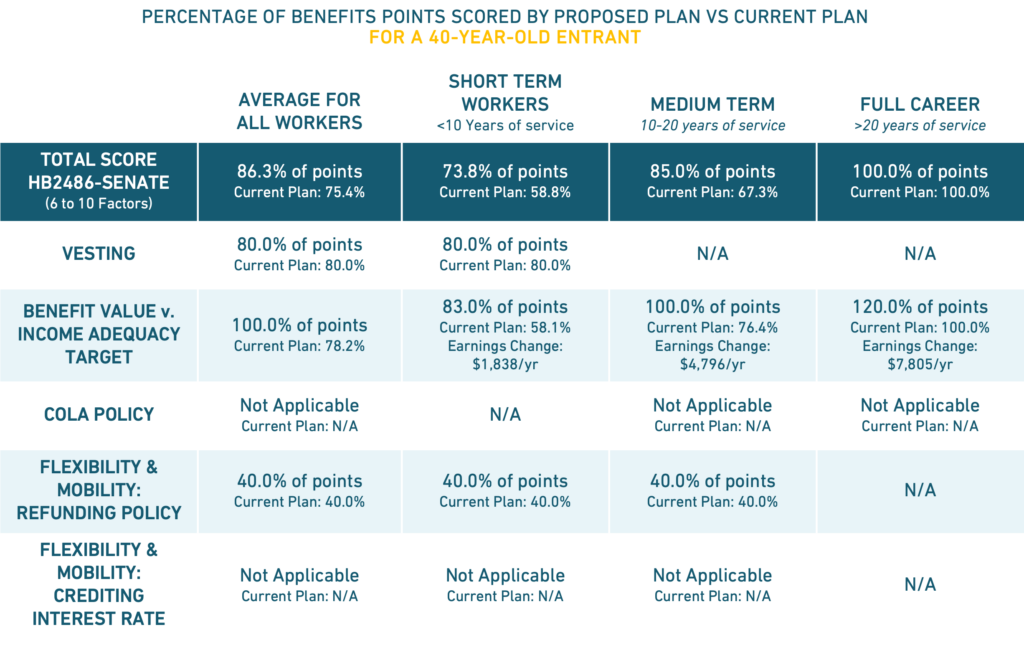

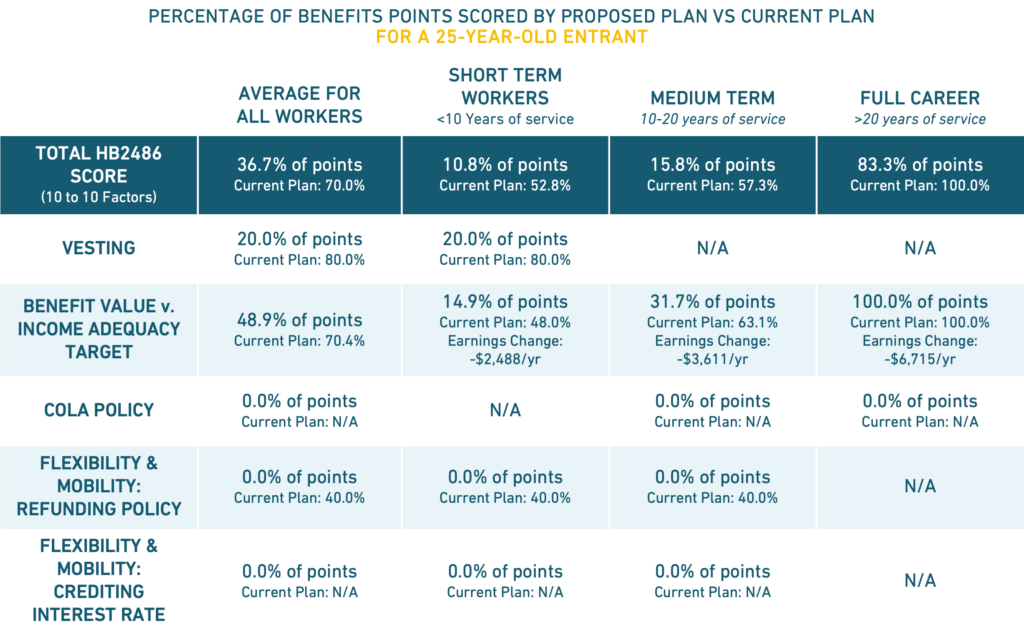

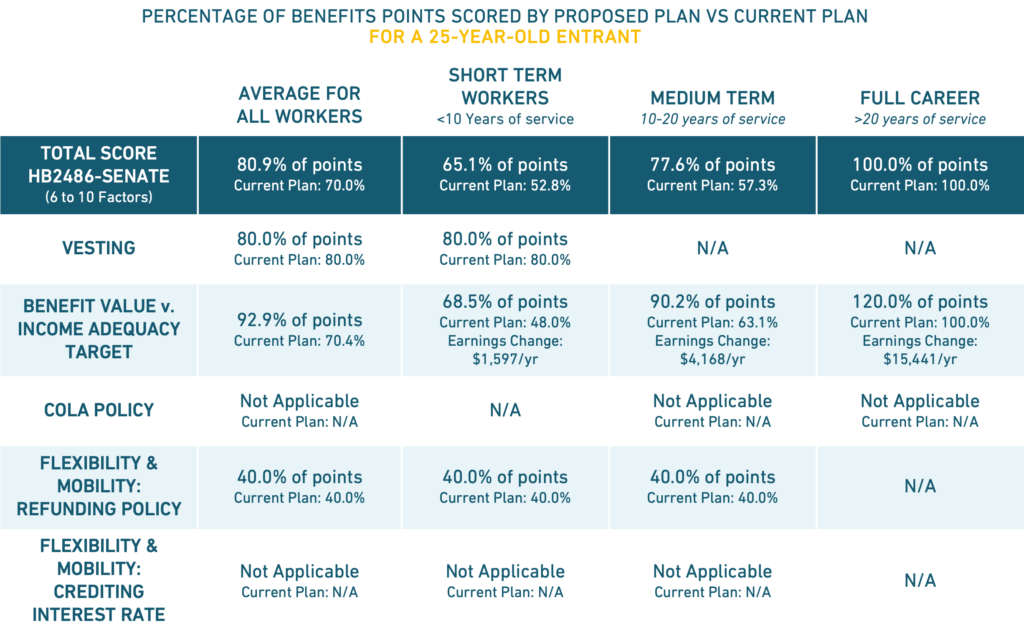

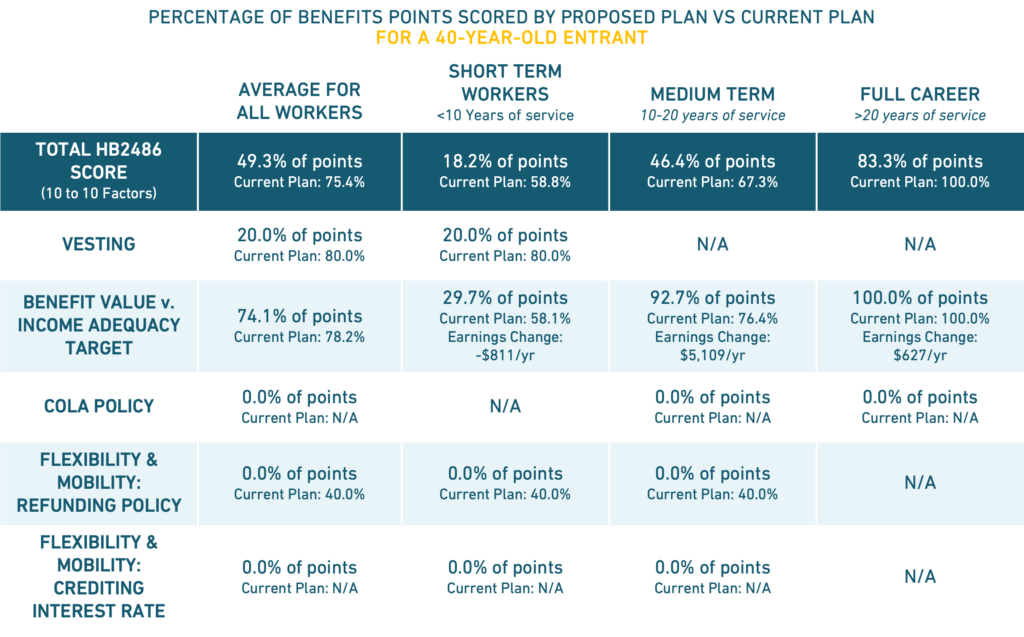

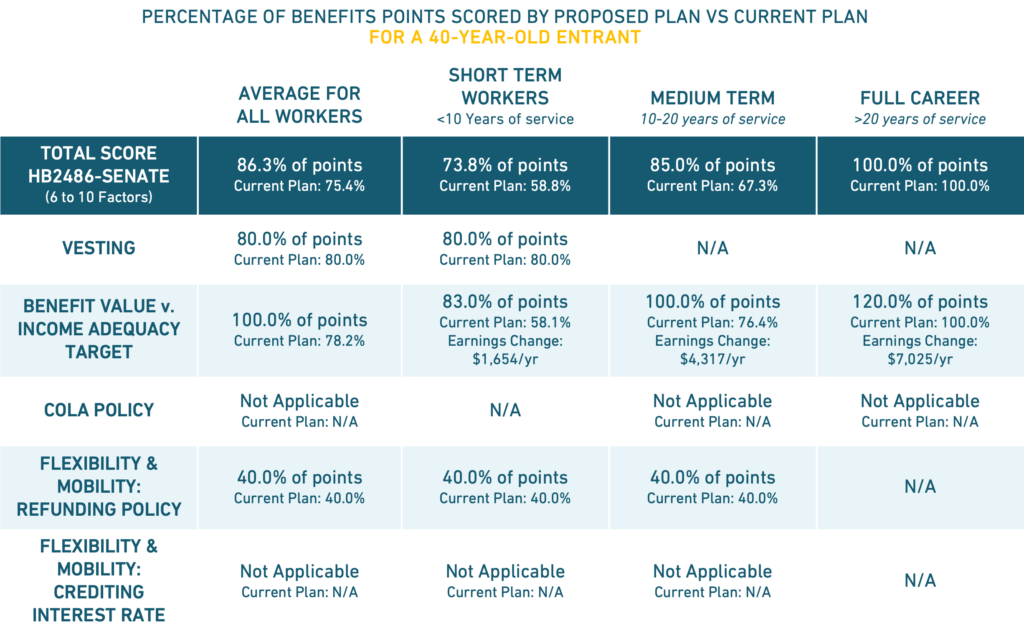

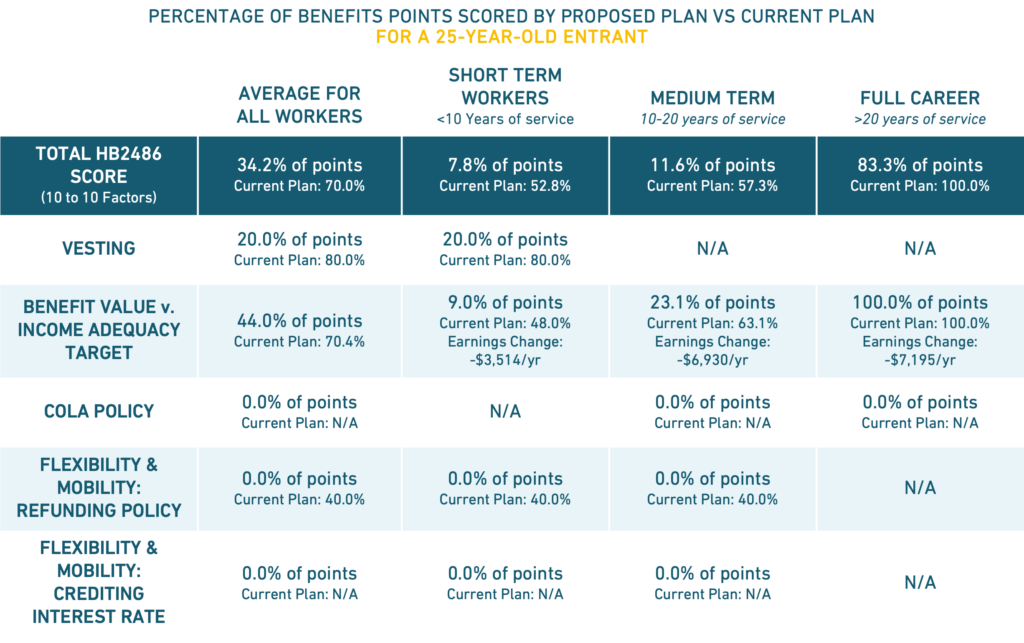

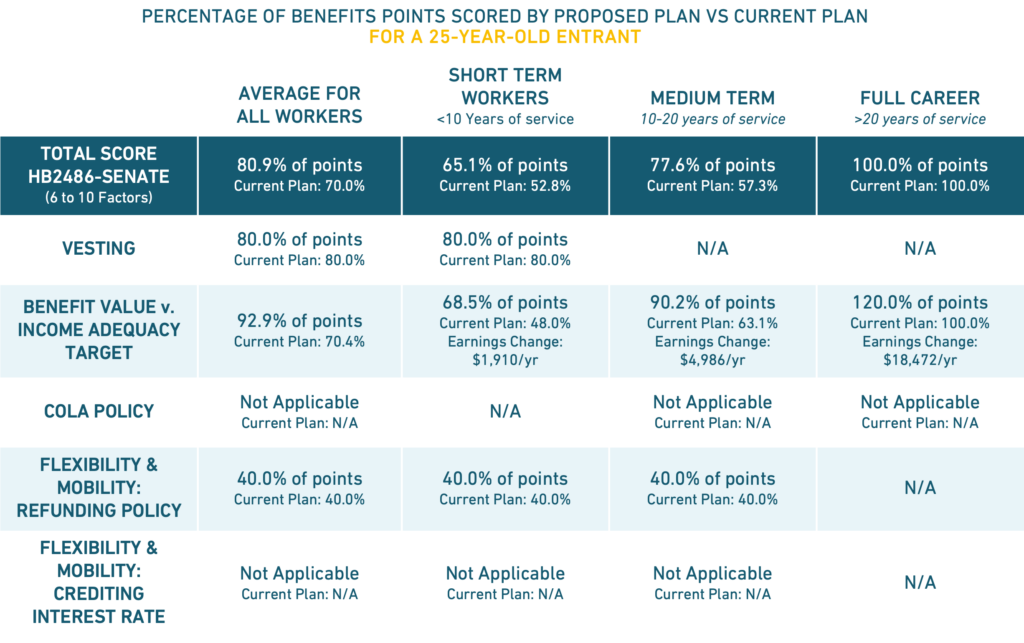

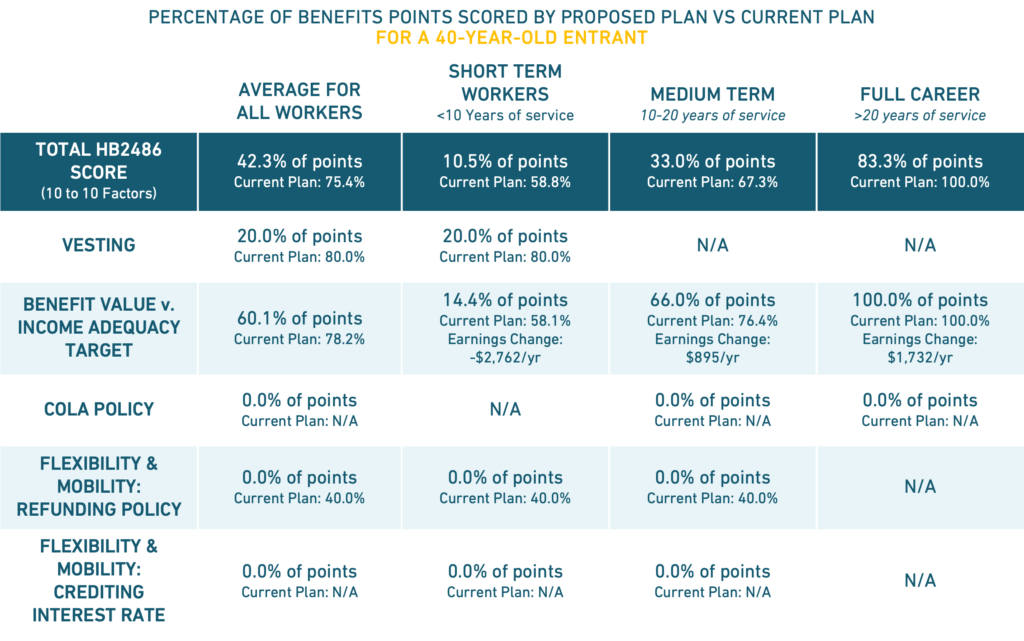

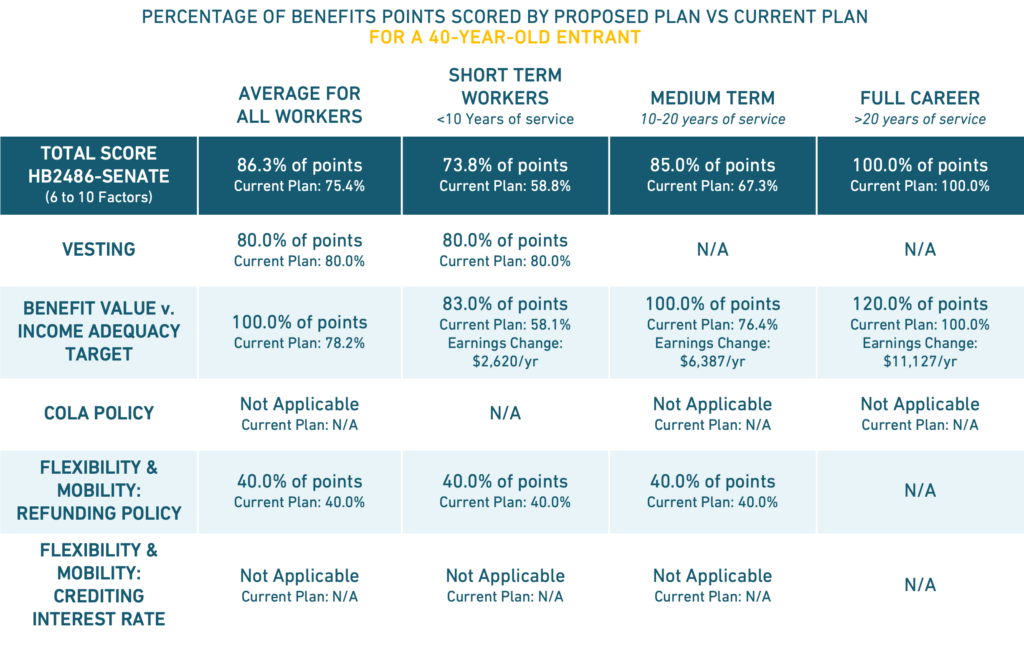

The tables above show the proposed plan’s total Benefit Scores, e.g., the percentage of available points for a given category. We also show how proposed changes would improve or decrease the Benefits Score of the current plan (the“score change”). And we show what the material effect would be on an average employee’s annual retirement earnings, using salary assumptions used by OPERS trustees.

For OPERS Members: The changes that HB2468 would mean are relatively similar for all OPERS members, but there are slight differences in the degree of change depending on if a member is classified as Regular, Hazardous, or Elected. To understand what HB2468 might mean for you based on your job classification or age of entry into the public workforce, see a detailed breakdown at the end of this article.

EQUABLE INSTITUTE’S ANALYSIS OF OKLAHOMA HOUSE BILL 2486:

Summary

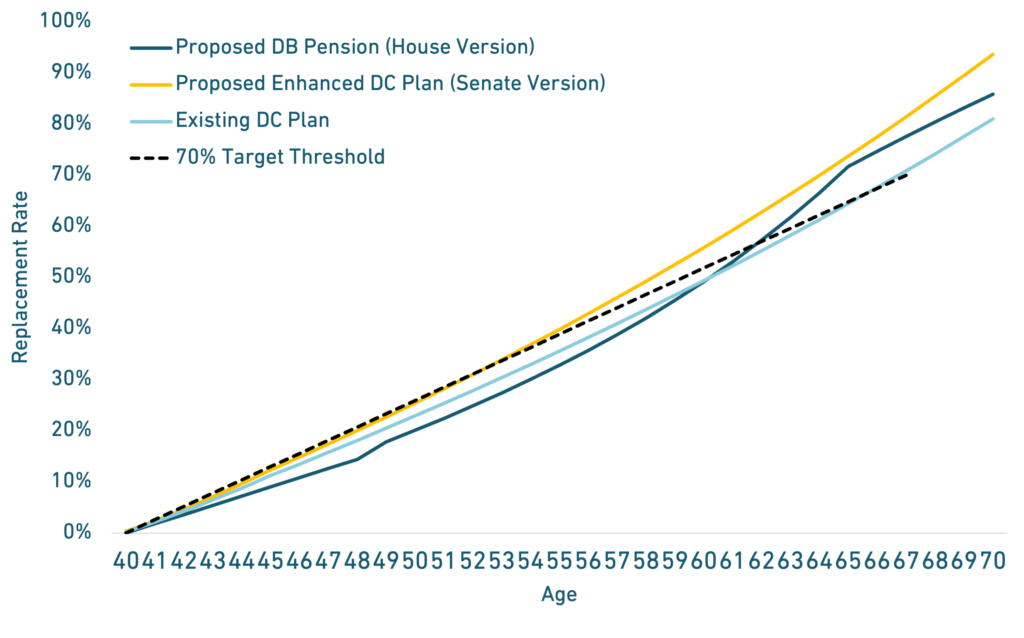

The proposed pension plan included in the House adopted version of HB2486 would provide substantially lower benefits to most OPERS members compared to the current defined contribution plan. This is primarily because the OPERS pension plan has no built-in inflation protection or crediting interest rate. However, the the proposed improvements to the OPERS defined contribution plan under HB2486 as amended in the state senate would increase retirement benefits for all members.

|

|

|

Pension plans are valuable because they can reduce investment risk for members, but the underlying benefit design provisions matter. For OPERS, the current defined contribution plan’s benefits are notably better than the legacy pension plan that HB2486 proposes to re-open. If the house adopted version had proposed a pension plan for current and new members with stronger benefit design provisions, then it is possible that the Retirement Benefits Scores would have exceeded the current plan.

The proposed changes in the Senate amended version are notably better than the version of HB2486 passed out of the House. That version would have reduced benefits for most members of OPERS, in exchange for the benefits provided being guaranteed income. Whereas the Senate version increases the value of retirement benefits for all members.

Assessing the Legislative Goals on Recruiting

Because the proposed pension plan does not provide meaningfully better benefits, it is unclear whether adopting HB55 would achieve the stated goal of its proponents to improve the ability of state agencies to recruit employees. However, even though OPERS benefits are better under the Senate amended proposed changes, it is not clear that version will help meet the stated goal of improving recruitment either.

Most academic literature suggests that few individuals join public service because of the retirement benefits, and other factors like salary, health benefits, and working conditions are stronger factors for retention than retirement benefits (nomatter the plan design).[6]

However, theoretically the underlying concerns about the current retirement plan could be addressed by:

(a) creating a new pension plan with adequate benefit design provisions that is an option for future OPERS members to choose, while still offering the current defined contribution plan. This could give state agencies an additional tool with which to recruit, even if it does not meaningfully help improve their ability to attract talent; and/or

(b) improve the current defined contribution plan by increasing employer contributions and offering lifetime income options to provide a better path to retirement income adequacy. This would be valuable to do even if it does not help with recruiting.

One of the reasons why OPERS was able to close their funding shortfall was a legislative commitment to paying in more than actuarially recommended each year. These overpayments will help make costs in the future lower. While this was a positive approach, unfortunately another method that Oklahoma used to reduce the OPERS funding shortfall was eliminating retirees cost-of-living adjustment. This has been helpful for the funded status of OPERS, but reduced benefits for members of the pension plan.

There are definitely better ways to approach improving benefits: Theoretically, a new pension plan could be created with benefits that are more likely to provide members with adequate retirement income. Current members could also be given the option to keep their defined contribution account, and/or all future members of OPERS could be given a choice between a pension plan and the current defined contribution plan. Or the current plan being offered could be enhanced by offering members a lifetime income option, such as converting accumulated account balances into an annuity upon retirement.

OKLAHOMA HOUSE BILL 2486 ANALYSIS BY CLASS OF MEMBERS:

House Version

Senate Version

What Oklahoma House Bill 55 Would Mean for 25-Year-Old New Hires & 40-Year-Old New Hires, by worker type

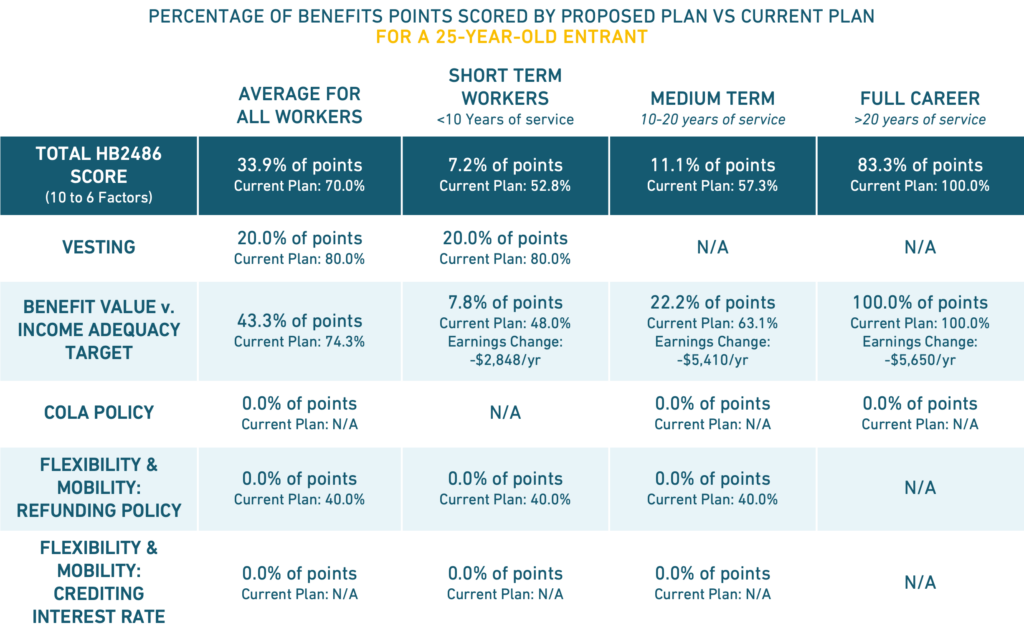

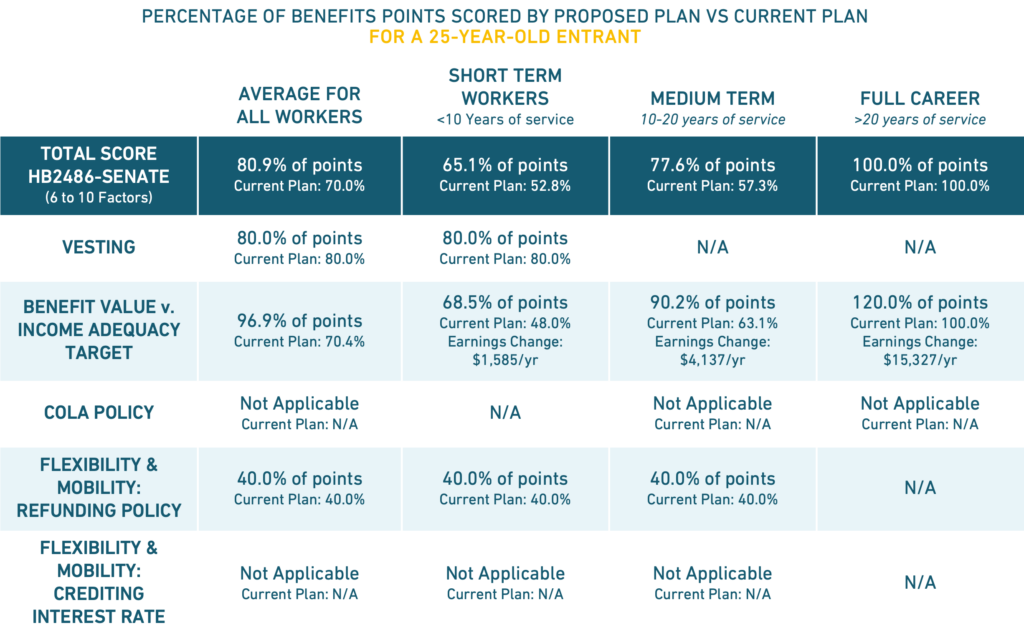

The tables below show the proposed plan’s total Benefit Scores, based on how old a member is when they are hired. We also show how proposed changes compare to the current plan for the same kind of public worker. And we show what the material effect would be on an average employee’s annual retirement earnings, using salary assumptions used by PERS trustees. Underneath each table is a figure that shows a comparative forecast for the value of benefits over time

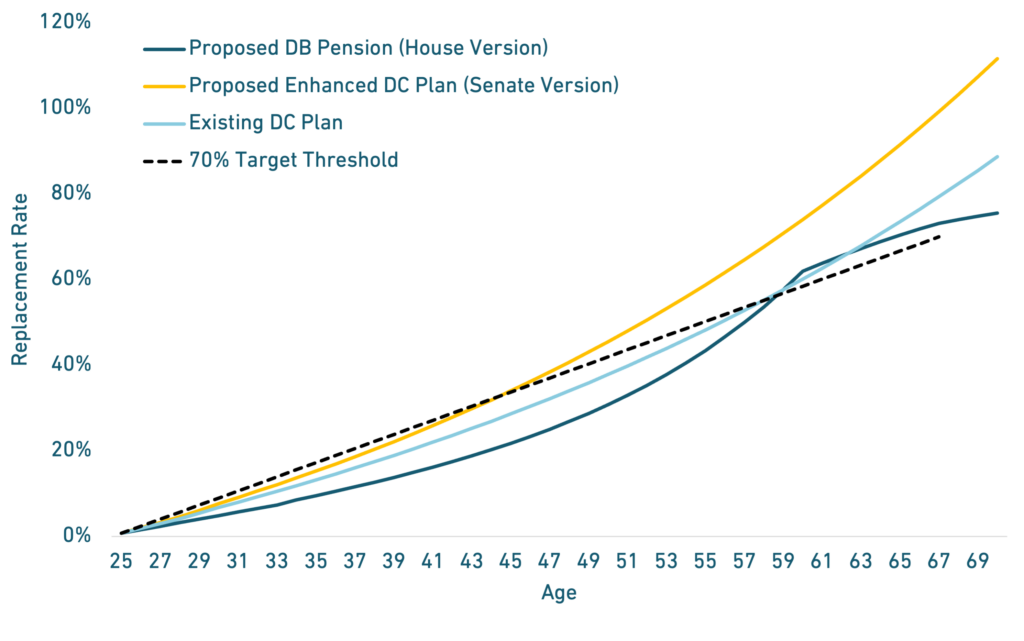

Regular Employees, 25-Year-Old Entrant

House Version

Senate Version

Benefit Value Analysis for Regular Employees, 25-Year-Old Entrant

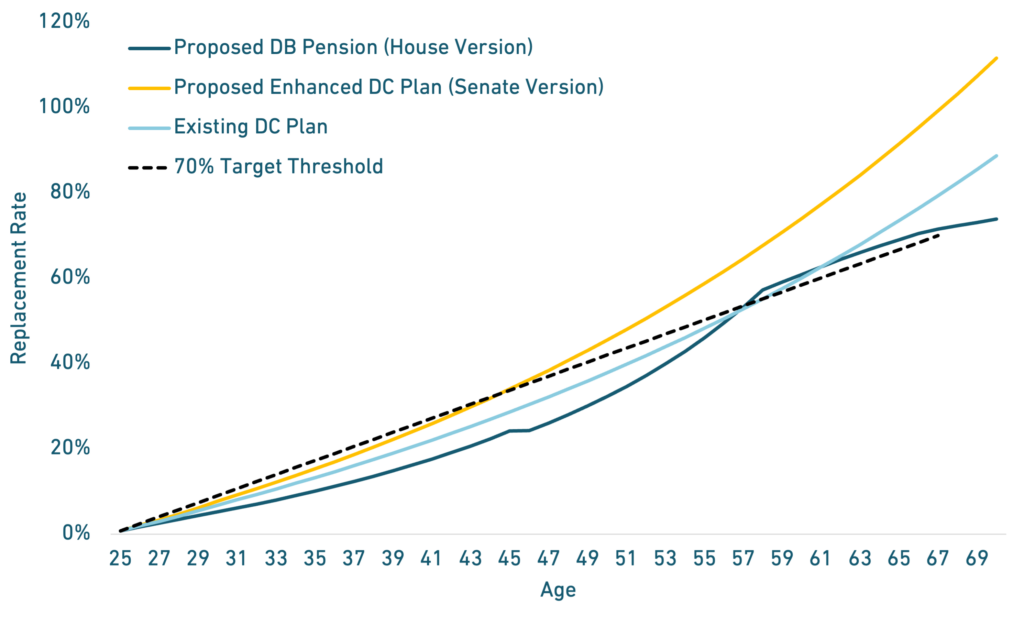

Regular Employees, 40-Year-Old Entrant

House Version

Senate Version

Benefit Value Analysis for Regular Employees, 40-Year-Old Entrant

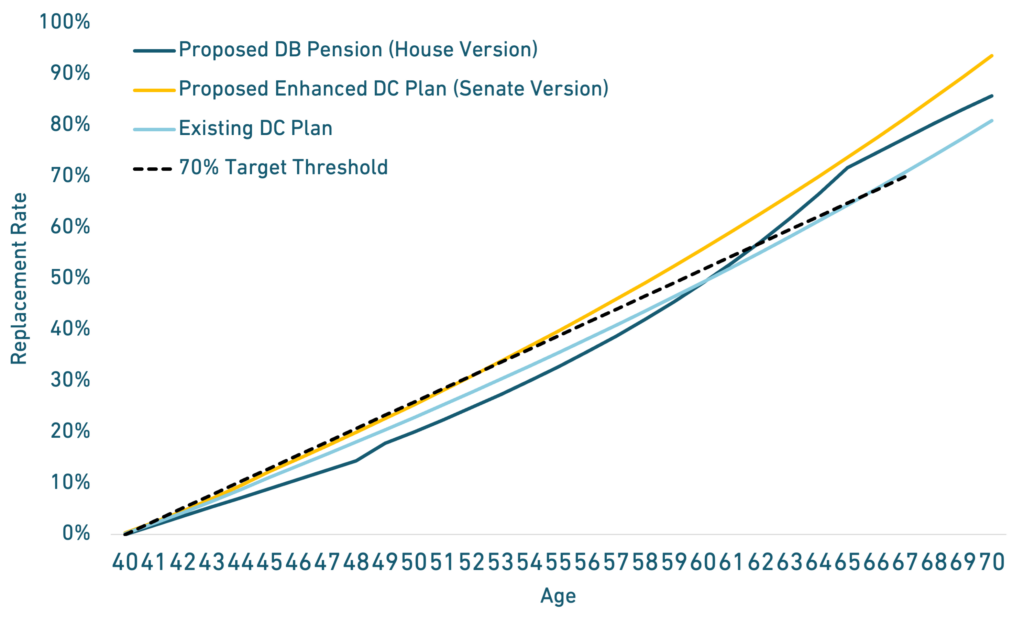

Hazardous Employees, 25-Year-Old Entrant

House Version

Senate Version

Benefit Value Analysis for Hazardous Employees, 25-Year-Old Entrant

Hazardous Employees, 40-Year-Old Entrant

House Version

Senate Version

Benefit Value Analysis for Hazardous Employees, 40-Year-Old Entrant

Elected Official, 25-Year-Old Entrant

House Version

Senate Version

Benefit Value Analysis for Elected Officials, 25-Year-Old Entrant

Elected Official, 40-Year-Old Entrant

House Version

Senate Version

Benefit Value Analysis for Elected Officials, 40-Year-Old Entrant