Statewide retirement systems have made positive moves in recent years, but those strides have not been good enough. Despite heavy investment returns in the most recent fiscal year and record-setting contribution increases, most pension plans only got back to their pre-recession levels and are unlikely to improve much in the near future. The primary reasons vary from state to state, but include:

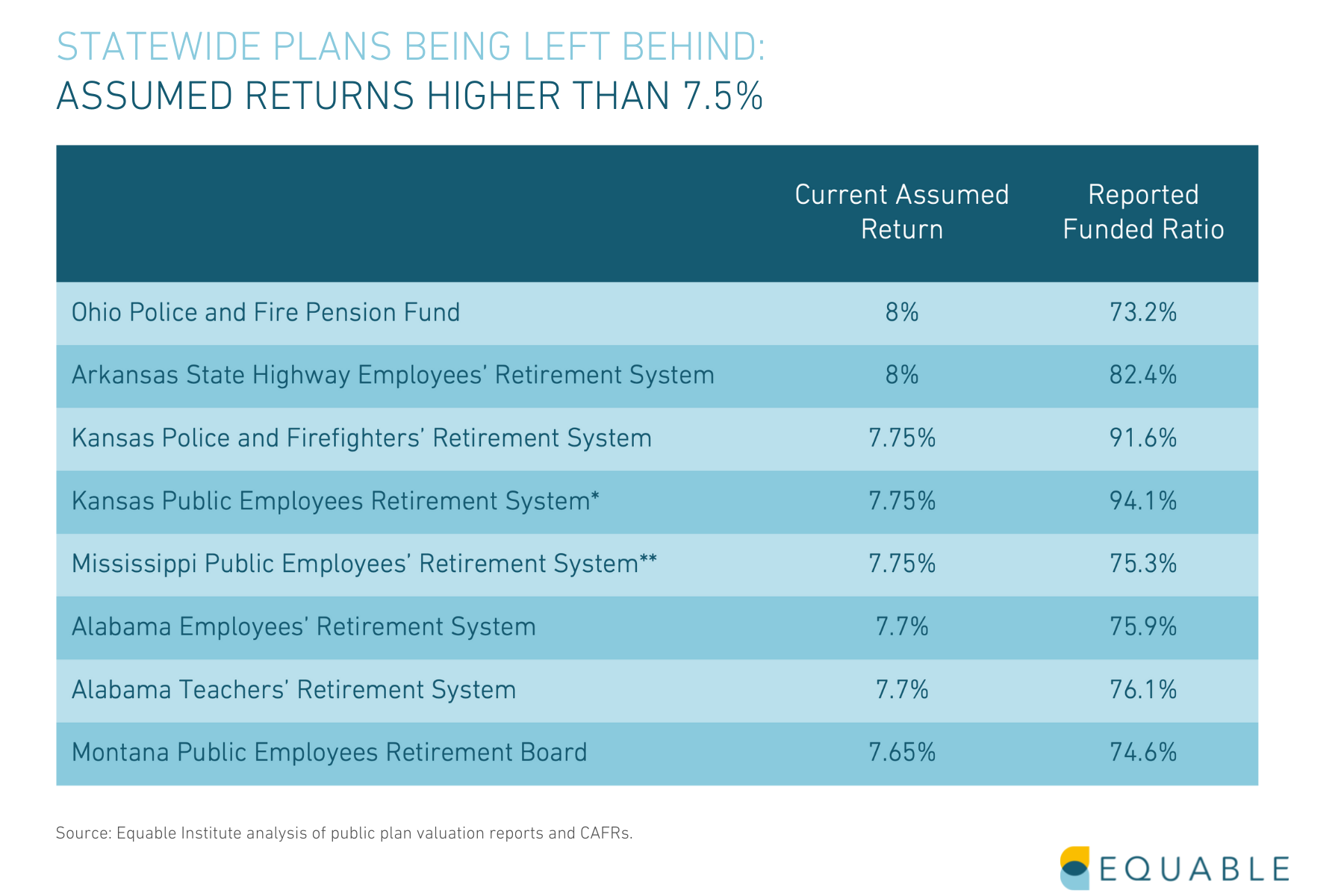

- Taking too long to adopt a more realistic assumed rate of return, which meant additional unfunded liabilities because of underperforming investments;

- Political apathy towards unfunded liabilities, which allowed moderate funded ratios to persist and additional unfunded liabilities because of interest accruing on that debt;

- Negative net cash flows despite those additional contributions, which meant a lower relative base of assets from which plans could earn their targeted rate of return.

Collectively, all of this and more meant statewide pension funds are unlikely to improve from fragile status.

The good news is that there are many lessons to be learned from the past decade that states can use to avoid letting the same thing happen again in the coming decade.

The feasibility of any pension policy changes are subject to political will and economic realities. While some states may be able to implement a gold-standard package of policy improvements, many may not. Here are some solution concepts based on those lessons learned, ranging from a holistic, best-case scenario strategy, to practical building blocks for a long-term improvement strategy.

The Ideal Strategy

- Update and reamortize legacy unfunded liabilities: It is usually a bad idea to use the “reamortization” process to push pension funding costs onto future generations. However, using unrealistic actuarial assumptions that lead to unfunded liabilities is a tacit way of doing the same thing. A reasonable trade can be made to get fragile systems on a solid footing for the future —

-

- States should draw on lessons learned from the last decade and move to update their investment assumptions immediately to reflect a lower return environment. [Here's why.]

- This will result in a higher, but more accurate measure of unfunded liabilities. States will be resistant to such accounting improvements because they are already under budget pressures due to low tax revenues and increased costs of public health services.

- So, in exchange for more accurate accounting, pension systems should draw a line between unfunded liabilities developed before the Great Recession or pandemic, and those that might be accrued afterward. Anything deemed “legacy” unfunded liabilities would be put on a new amortization schedule, over 25 to 30 years. [Or Longer.]

- Borrow at low interest rates: One positive about the low interest rate environment is that it is theoretically possible for a state to develop a long-term (i.e. 30 to 50 years), special bond proposal that would require paying very low interests. In general, “pension obligation bonds” can be very risky. [ Here's why. ] In the context of the Age of COVID, these might be risks worth taking for a state that can develop a sound plan for how it will raise the special bond, how it will invest the money, and how it will manage the excess returns on the bond. The gains from asset scale (i.e. having more money in the asset base to invest from) combined with the possibility of borrowing at near zero rates, make this a prospect worth considering for states with decent credit ratings.

- New pension plans built for resilience: States that want to continue offering pension benefits to newly hired public sector employees, create new retirement plans that start with conservative assumptions on investment, mortality, and payroll growth so that there is a low risk of underperformance. These plans should at least include risk-sharing features similar to the consistently fully funded plans in Wisconsin and South Dakota that have allowed them to stay resilient even when investment returns are low. And they could also include various other features of modern defined benefit plans that allow for cost-sharing (see Michigan Teachers) or portability of employer contributions (see Colorado State).

Who is this strategy for?

- Any state with an assumed rate of return over 6.5% should consider the framework of this strategy. Pension funds over 90% funded that are already using an investment assumption closer to 7% might already have the tools necessary to maintain a resilient funded status without having to use all of the steps above, but they should still seek to update their assumptions.

- States that have already adopted a new retirement plan design for new hires won’t need to use the final step, but could still have legacy unfunded liabilities creating contribution rate challenges. Michigan, Pennsylvania, Rhode Island, and Utah are some examples.

- Any state with a funded ratio that has been consistently below 90% for two to three years in a row. Just because there isn’t a risk of insolvency in the near future, doesn’t mean the cost pressures of consistently paying down unfunded liabilities aren’t a growing concern. Examples of plans like this that need to be addressed include: Florida Retirement System, Georgia Teachers’ Retirement System, New Mexico Education Retirement Board, and both of North Dakota’s statewide plans.

- States with good credit ratings and the political leadership necessary to manage a complicated, multi stakeholder process. Trust between a legislature and governor’s office is helpful, and having a champion(s) to drive the process forward is particularly important.

The Strategy Just for Legacy Unfunded Liabilities

- Update and reamortize legacy unfunded liabilities (see above)

- Borrow at low interest rates (see above)

Who is this strategy for?

- Any state that meets the criteria for the Ideal Strategy, but that doesn’t have the political environment necessary to discuss building new retirement plans for the future. Retirement plan design is a politically fraught issue for most states, and in some cases it may be appropriate to address improving the overall retirement system in phases.

The Strategy For Low Credit Rated States with Distressed Funded Status

- Update and reamortize legacy unfunded liabilities (see above)

- Develop a comprehensive strategy via bipartisan, multilateral stakeholder process: There are statewide pension systems where adjusting contribution rates and actuarial assumptions are not going to be enough to create a path toward resilience. And there are some states where the contributions necessary to get back to full funding quickly are politically prohibitive based on existing taxpayer resources. In these cases, a comprehensive strategy needs to be developed that would include some mix of contribution rate increases (perhaps for employees and employers), actuarial assumption adjustments, tax increases, and constitutionally permissible benefit adjustments — such as linking COLAs to funded status (a process adopted by Arizona Public Safety and Colorado Public Employees).

Who is this strategy for?

- There are some states that will not have the credit rating or technical specialists to successfully manage a special pension bond issuance. There are a few states where the level of unfunded liabilities relative to the state’s GDP and annual expenditures is just so high that a custom process is necessary to reach a solution — Connecticut, Kentucky, Illinois, and New Jersey all come to mind.