Defined benefit plans are a common way to provide retirement income. The most typical defined benefit plan is based on final average salary, and is often called a “pension plan.” And these are also a frequent way that state and local governments provide retirement benefits too — notionally called public defined benefit plans.

There are a lot of myths and misunderstandings about defined benefit plans, perhaps because such retirement plans are now less common among private sector employees. In this article we’ll explain about a few different kinds of defined benefit plans, provide typical examples, and compare pros and cons.

The Overview:

The thing being “defined” in defined benefit pension plan is a formula that will be used to determine future retirement income.

That formula is based on three things:

- the years that someone works;

- their final average salary (also known as final average compensation, or final average pay, or even highest average salary); and

- a benefit “multiplier” or “accrual rate.”

Notably, the formula does not take into account the amount of money actually saved or even what is contributed into the pension fund. The money contributed by employers and pension plan members matters for building up assets that can pay promised benefits, but the benefit amount paid is only based on the pension formula.

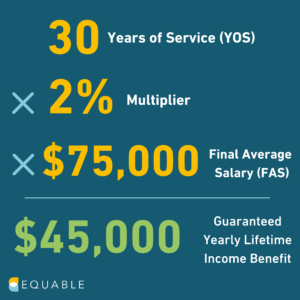

Here is a way to visualize how pension formulas work:

- Years of Service (YOS): How many qualifying years you’ve worked for your employer within the pension plan.

- Multiplier: This number is predetermined in state statutes and can vary by state and hire date.

- Final Average Salary (FAS): The average salary of the last three or five years of work (in most states). Some states use the three or five highest years of salary. Either way, it is a reference to the compensation amount that your pension will be based on.

The “multiplier” in the formula is used to determine the percentage of your final average salary that you will receive as a retirement benefit. Your years of service are multiplied using this specific number. That amount becomes a percentage of your final average salary. And the result equals the amount you’ll ultimately receive as a benefit when you retire. The higher the multiplier, the larger the benefit. Multipliers are sometimes known by other terms, such as “accrual rate” or “crediting rate” but they mean the same thing.

A Typical Example:

A typical multiplier for defined benefit plans is 2%. So, if you work 30 years, and your final average salary is $75,000, then your pension benefit would be calculated like this:

That $45,000 becomes your guaranteed lifetime annual income.

An important way to think about the formula: in this example the result of 30 years of service is a pension that is worth 60% of the final average salary. The 30 years are multiplied by the 2% multiplier, and that is equal to the 60% replacement rate.

Other Kinds of Defined Benefit Plans:

Public defined benefit plans usually are set up as final average salary pensions. However, another kind of defined benefit plan is called a guaranteed return plan (sometimes called a “cash balance” plan).

The thing being defined in a guaranteed return plan is a minimum investment return on contributed assets.

Members of retirement plans and employers both make contributions into guaranteed return plans. The retirement system that collects the money manages the assets and invests on behalf of all employees enrolled in the plan. Members get at least a certain amount of investment return — such as 4% — plus they can share in the upside returns above this minimum guaranteed rate.

These kind of retirement plans are most common in Kansas, Kentucky, and Texas. A typical example is employees contributing into a guaranteed return plan account, promised 4% minimum returns, and three-quarters (75%) of any returns above that minimum. So if a retirement system earns 8% returns in a given period of time, members of the plan will get 7% returns on their money and 1% will be aside to help ensure guarantees in the future will be paid when investments are low.

When an individual retires all of the money they have accumulated in their guaranteed return plan account can be converted into an “annuity” which pays out a lifetime stream of income, just like a pension.

The Pros and Cons of Defined Benefit Plans:

There are various ways that retirement benefits can be offered. Each can be measured against different kinds of objectives. Here is how defined benefit plans compare to other retirement plans on a few common goals that states and local employers have for offering retirement benefits in the first place.