The first quarter of 2020 was overrun by the economic impact of COVID-19.

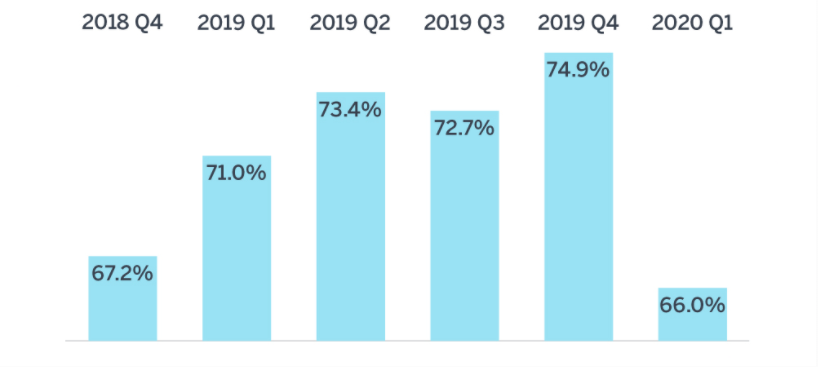

Right off the heels of a Q4 2019 high water mark for public pension assets, Q1 investment losses have lowered the estimated funded status of the 100 largest U.S. public pension plans as measured by the Milliman 100 Public Pension Funding Index (PPFI), from 74.9% at the end of December 2019 to 66.0% at the end of March 2020. The deficit ballooned to $1.819 trillion at the end of March 2020, up from $1.334 trillion at the end of December 2019. Plans are now at the lowest funding levels since the PPFI began in September 2016, eliminating all of the funding level improvements that were made in 2019.

Figure 1: Funded ratio

In aggregate, the PPFI plans experienced investment returns of -10.81% in Q1, with individual plans’ estimated returns ranging from -17.41% to 4.76%. The Milliman 100 PPFI asset value decreased from a PPFI high of $3.979 trillion at the end of Q4 2019 to a PPFI low of $3.536 trillion at the end of Q1 2020. The plans lost market value of approximately $419 billion, on top of net negative cash flow of approximately $24 billion.

The total pension liability (TPL) continues to grow and stood at an estimated $5.355 trillion at the end of Q1 2020, up from $5.313 trillion at the end of Q4 2019. Just as pension assets grow over time with investment income and shrink over time as benefits are paid, so too does the TPL grow over time with interest and shrink as benefits are paid. The TPL also grows as active members accrue pension benefits.

Read the rest of the report at Milliman.

_______________

This article republishes selections from “Public Pension Funding Index, 1st Quarter 2020″ a report by Rebecca A. Sielman for Milliman, 4/16/2020.