State of Pensions 2021 report is an annual report on the status of statewide public pension systems, put into a historic context. State and local governments face a wide range of challenges in general – and some of the largest are growing and unpredictable pension costs. The scale and effects of these challenges is best understood by considering the context of multi-decade financial trends that have brought public sector retirement systems to this moment.

And though many statewide retirement systems have made strides in improving their funded status, and recouped some of the losses experienced during the Covid-19 pandemic, the state of pensions in America is, unfortunately, still fragile. Overall, America’s public pensions are now back to where they were in 2008 before the Great Recession.

Here are some of the highlights of Equable’s State of Pensions 2021 report:

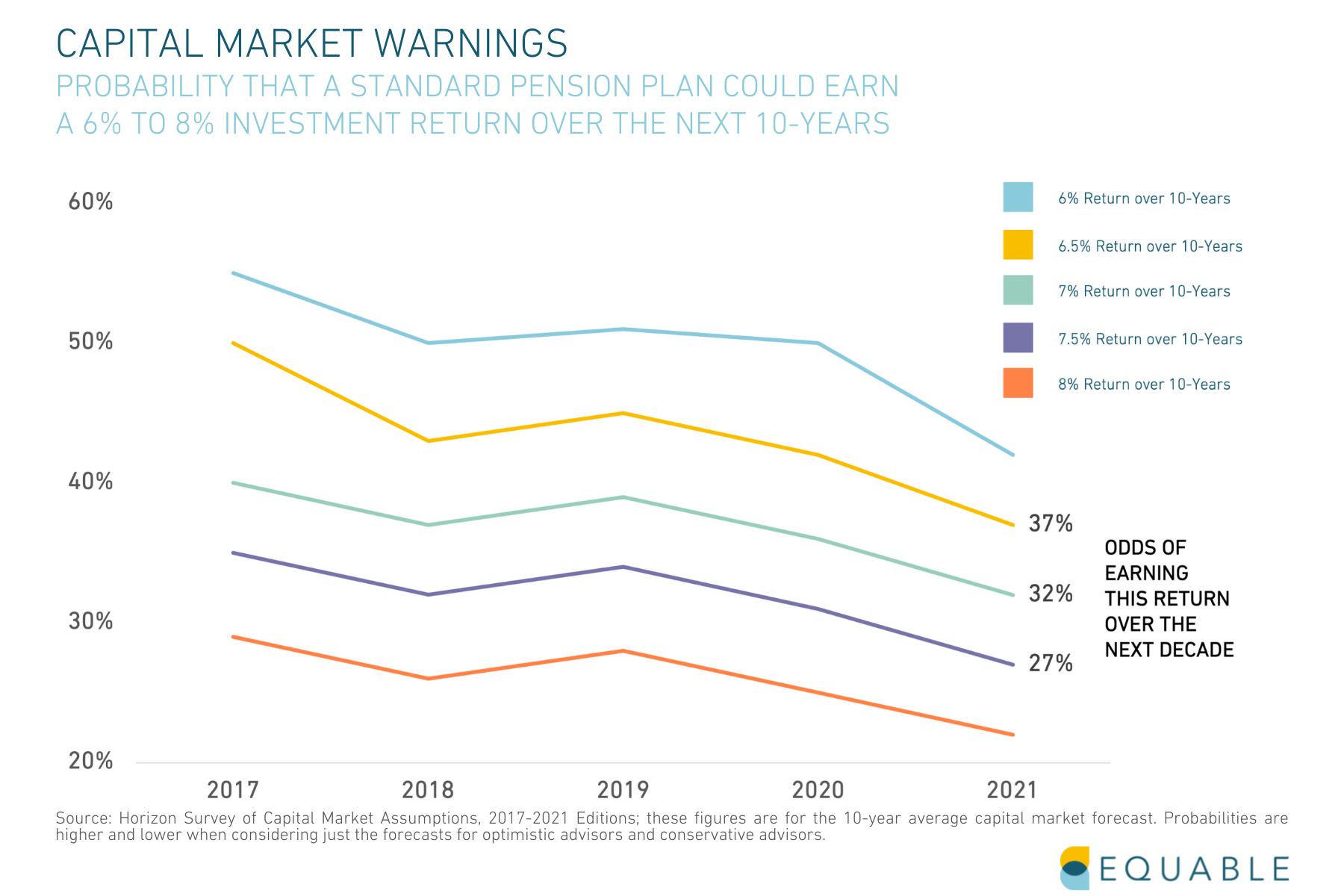

Consider that even with the strongest investment return year of the 20th century, public pension plans are still well below their funded status prior to the Great Recession. Add to that, even the most optimistic capital market forecasts are more pessimistic now than they were at this point in time last year (before vaccines and federal fiscal stimulus changed the outlook on pandemic economic effects). So in some respect the high returns this year can also be viewed in part as a warning about more muted financial performance in the coming years.

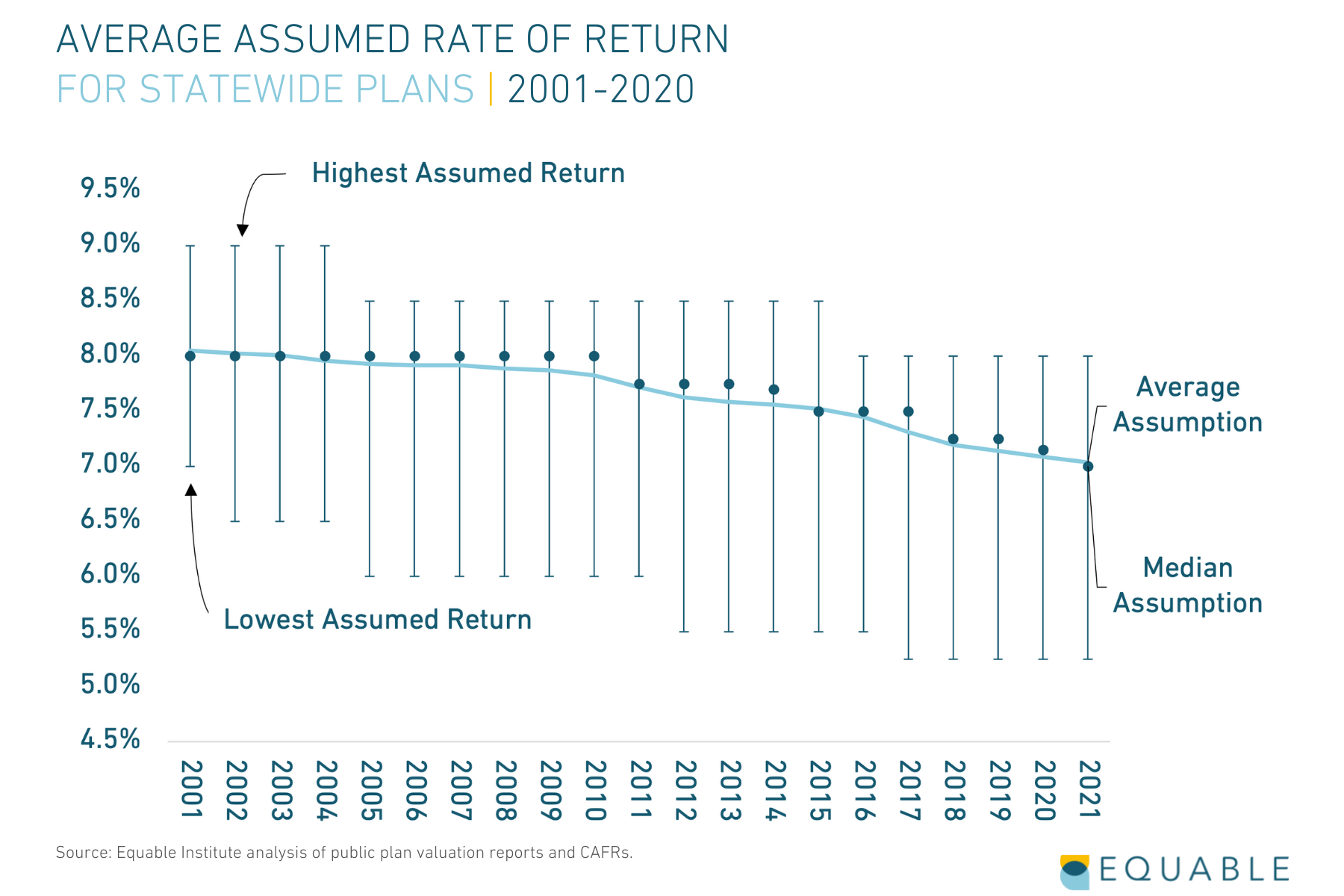

That warning is certainly something that pension board trustees have been taking to heart. As of this writing 28 retirement systems managing 42 plans have already announced changes to their assumed rates of return, effective for 2021. Looking forward we anticipate that state retirement plans will continue to lower their investment assumptions (though we don’t think it will happen as quickly as it should), and this will mean increase in the measurement of unfunded liabilities.

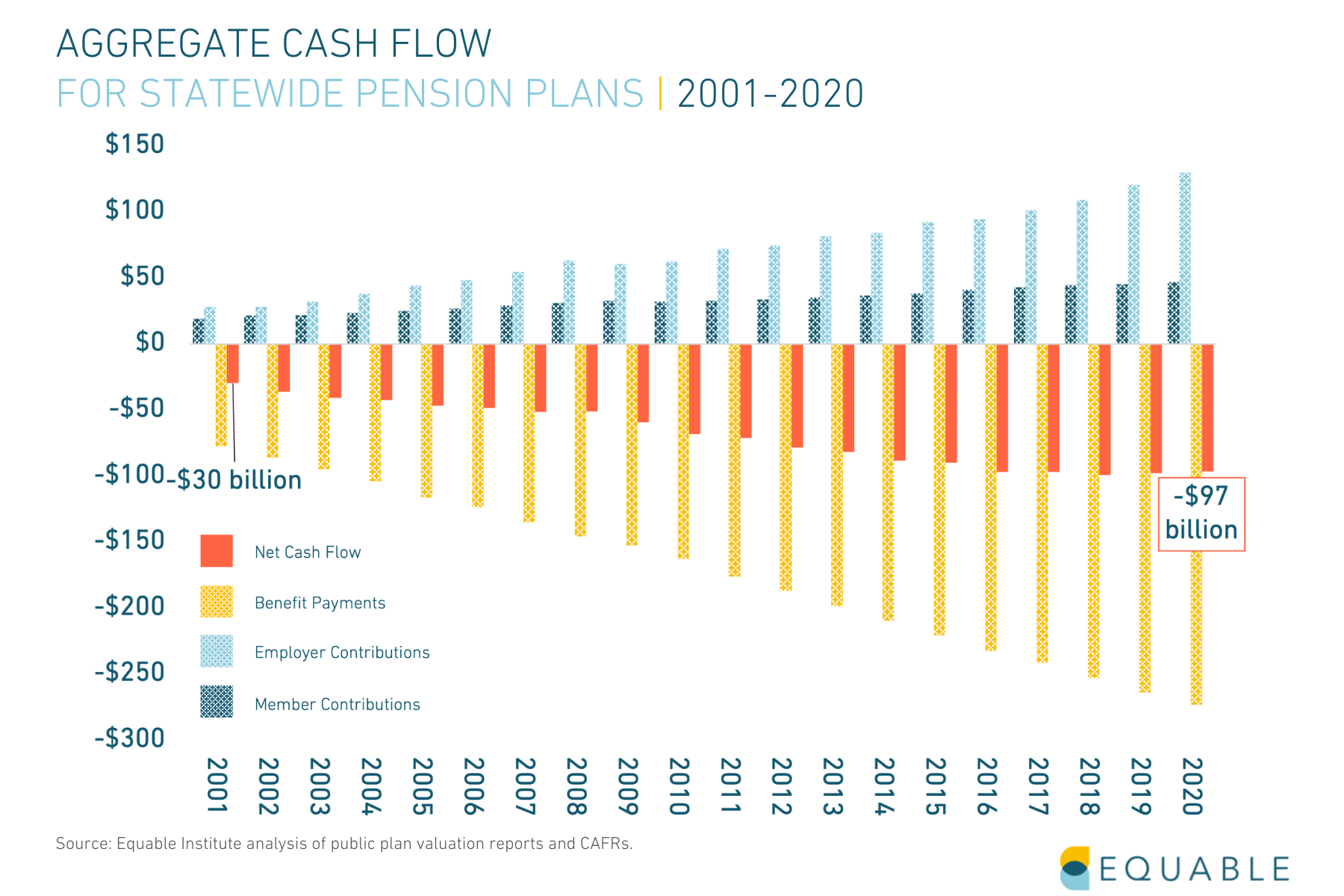

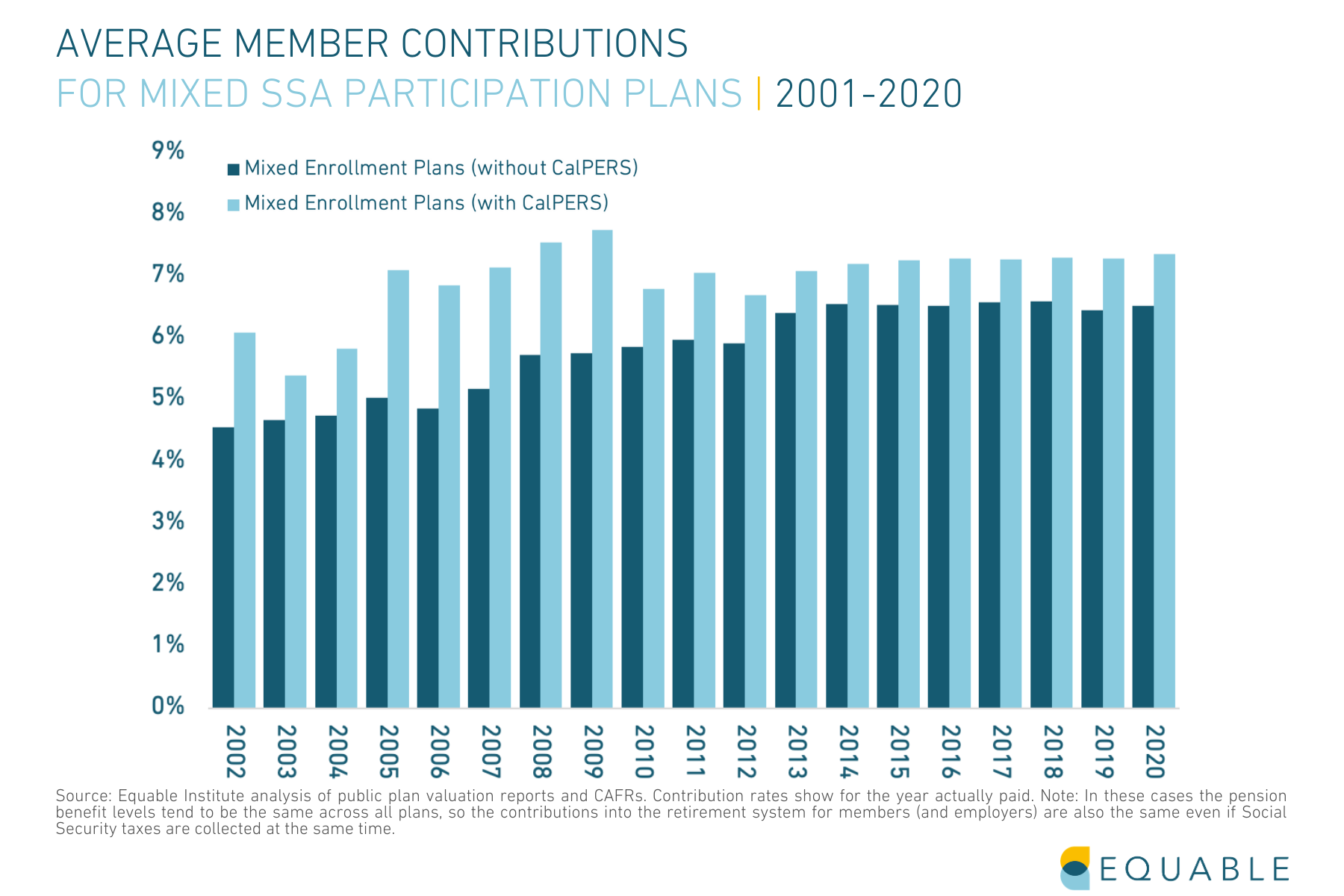

Perhaps a more pressing concern is that the negative trends on contribution rates and cash flows are persisting. And while growing contribution rates will not be good news for taxpayers and legislators, retirement plan directors will welcome those additional contributions as inflation concerns are likely to lead to higher benefit payments, adding to existing cash flow pressures.

Factoring in the recently announced reductions in assumed returns with lower capital market forecasts, it is inevitable that contribution rates will be higher in the coming years. Retirement plan directors will welcome those additional contributions as inflation concerns are likely to lead to higher benefit payments, adding to existing cash flow pressures.

And inflation will not be the only pressing political issue that state leaders will face in the coming months.

To learn more about the State of Pensions 2021 report, visit equable.org/stateofpensions2021