S&P Global Rating’s analyzes state and local pension plans from the perspective municipal bond holders, the organizations that lend money to state and local governments. As part of this process, S&P Global has developed their own metrics of what governments should be contributing to their pension plans, in part based on a more conservative estimate of the value of total pensions promised by each state. And against this benchmark, most states are coming up short in what they should be putting into their pension funds.

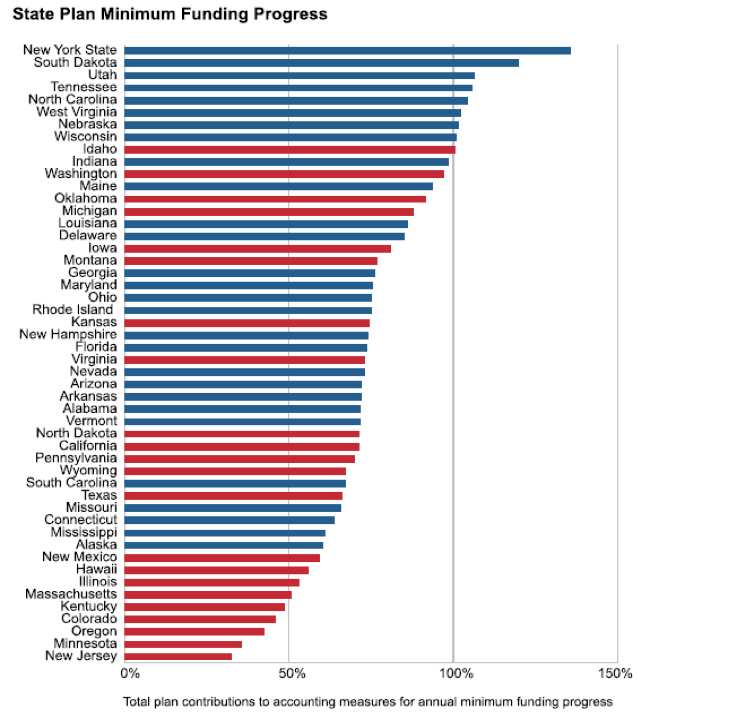

“U.S. State Pensions Struggle For Gains Amid Market Shifts And Demographic Headwinds” is an analysis of the funded status of public plans based on internal metrics at S&P Global. While much of the study is behind a paywall, certain portions have been regularly published for public consumption, including S&P Global’s “minimum funding progress” benchmark (shown above).

The red bars in the graphic indicate states that typically do not meet the actuarially determined contribution from their own actuaries. In these states it is possible that fixed, statutory contributions might be sufficient to fund the pension plan, but often this is not the case. The blue bars show states that typically meet or exceed the contribution rates determined by their own actuarial advisors.

“In our view, states that consistently fund full required contributions on an actuarial basis and use conservative assumptions and methods are more likely to effectively manage their pension liabilities and the associated long-term budgetary costs than states that do not,” according to Todd Kanaster, Director of Pension Analytics for S&P Global.

For more details on the graphic, you can review this presentation at the National Council on State Legislatures.

For more about funded status, see Equable’s analysis.

_______________

This article shows analysis from S&P Global Ratings, originally published in “U.S. State Pensions Struggle For Gains Amid Market Shifts And Demographic Headwinds” during October 2018.