When it comes to funding defined benefit pension plans, it is commonly understood that the discount rate used to compute liabilities plays a significant role. For any given pension plan, a lower discount rate results in a higher liability, which means a lower funded status. Discount rates, however, are only one of a multitude of factors involved in pension funding. Other factors include the approach to plan and risk management, methods for computing assets and liabilities, the length of time and methods for amortizing unfunded liabilities, and the way that contributions are determined.

This article compares the recent historical relationship between pension plan funded status and discount rates used to compute liabilities for funding purposes. Comparisons include all three major categories of defined benefit pension plans in the United States: single employer (SE) plans, multiemployer (ME) plans, and state and large city public plans (PP). Reflection is limited to the question of whether discount rates were driving the differences in funded status, without any attempt to explain why funded status differs. […]

Here is a summary of key findings from 2009-2014:

- In general, funding discount rates for PP and ME plans were significantly greater than those for SE plans, with PP discount rates having been somewhat greater than ME rates.

- Although the category with the greatest discount rates (PP) was the least well funded, statistical analysis reveals that discount rates were probably not driving the differences in funding levels. While they are not explored in this article, many other factors involved in pension plan funding also differed among and within pension plan categories, including methods for computing unfunded liabilities, overall approaches to plan and risk management, and the way that contributions are determined. […]

Discount Rates for 2014

The theoretical basis for selecting discount rates to calculate funding liabilities differs among plan categories and is subject to ongoing debate. SE plans are legally required to use a modified market-based discount rate, while ME and PP actuaries typically use an expected-return approach to set the discount rate. Usually, expected-return discount rates are greater than market-based discount rates, resulting in lesser liabilities for a given plan.

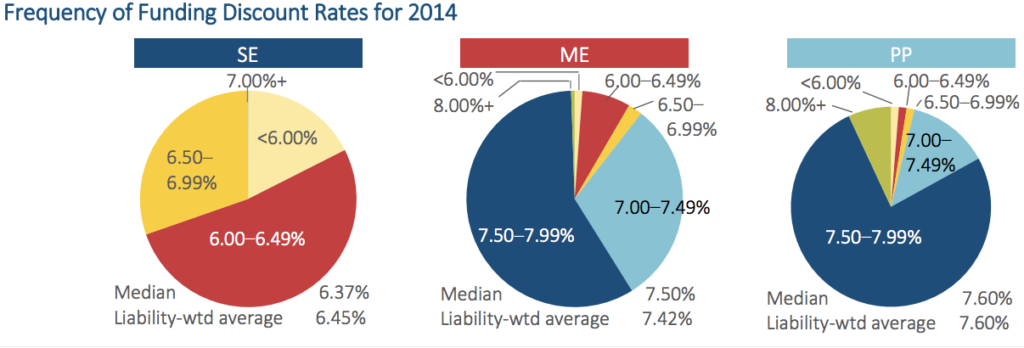

The following graph compares the frequency of discount rates for funding purposes for 2014, the most recent year available for all three categories of plans. Note that when the liability-weighted average differs significantly from the median, it is usually because the rates of the largest plans differ significantly from those of most plans.

Source: Society of Actuaries

The difference in discount rates among plan categories is obvious. For 2014, three-quarters of the public plans were using a discount rate between 7.50% and 7.99%, while three out of five ME plans were using a rate in the same range, but virtually none of the SE plans were using rates that high. One in 14 public plans (7%) was using a discount rate of 8.00% or greater, compared to only 1% of ME plans using a discount rate that high. At the low end of the scale, nearly one in five (18%) SE plans was using a discount rate less than 6.00%, compared to only 1% of ME plans and 2% of public plans using a discount rate that low.

For more about the analysis of these discount rates and their relationship to funded ratios, check out the rest of the paper.

_______________

This article quotes selections from “U.S. Pension Plan Discount Rate Comparison 2009-2014” a research paper by the Society of Actuaries in September 2016. Content selections are from pages 1-3. The whole paper is available here.