South Carolina teachers’, public safety officers’, and public workers’ pension benefits are entitled to certain protections under state law and affirmed by court rulings. At the same time, the state does have some legal precedent that allows them to change particular aspects of retirement benefits.

In other words, South Carolina pension laws allow parts of public pension benefits to be changed by future state laws, but only certain parts of those benefits.

Equable Institute partnered with Columbia Law School’s Center for Public Research and Leadership to create infographics that map states’ pension governance. Understanding the legal environment for pension policies can be confusing for both lawmakers and public workers, but illuminating legally permissible policy pathways to improve funding sustainability and ensure adequate retirement income security for states’ workforces is essential.

Understanding South Carolina Pension Laws

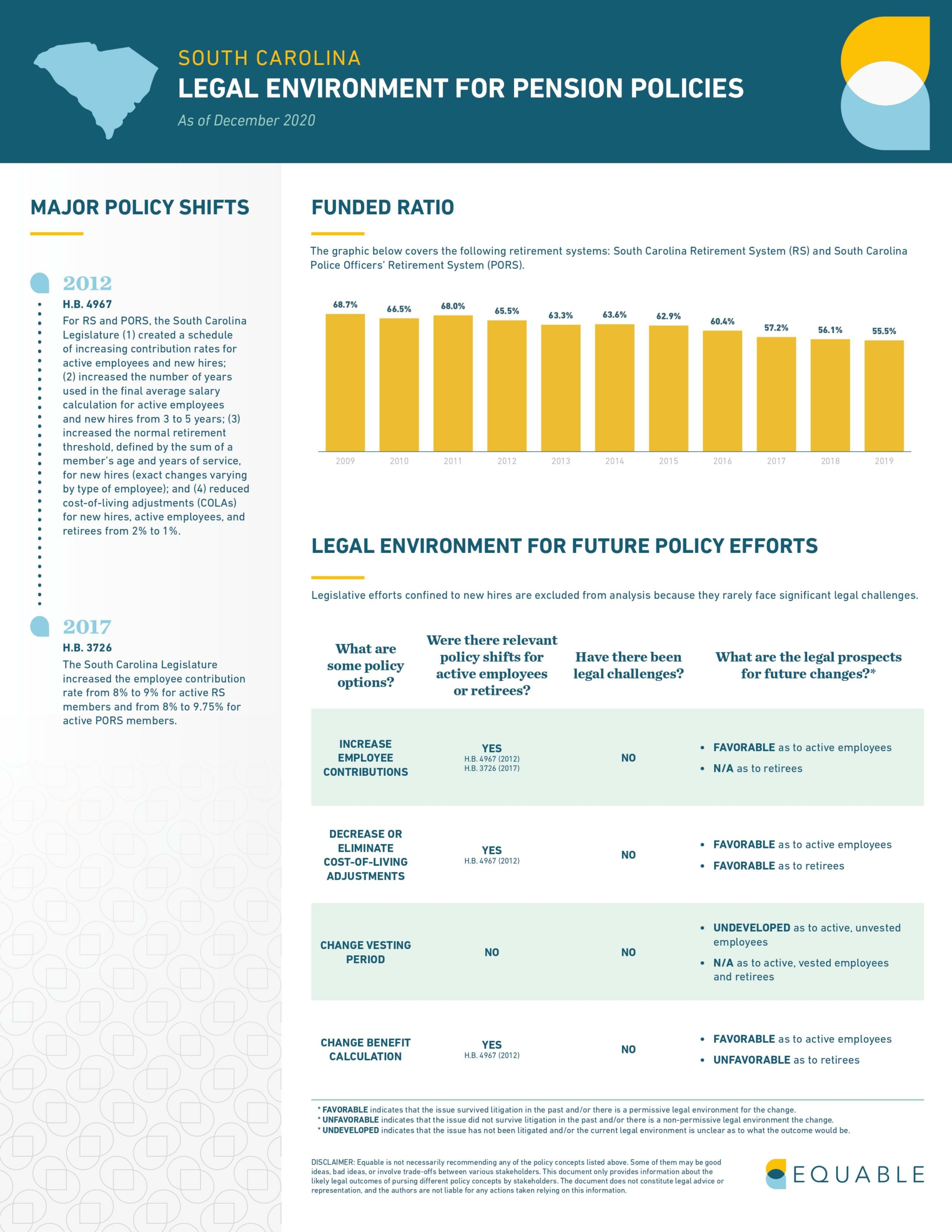

In the case of South Carolina, state law allows the legislature to increase employee contributions for public workers. In 2012, they did just that, creating a schedule of increasing contribution rates for active employees and new hires. Lawmakers increased contribution rates again in 2017, with no legal challenge from public workers.

The law also allows for changed to benefit calculations, which the legislature did in 2012 when it increased the years used in calculating final average salary from three to five years. Cost-of-living adjustments have also been reduced from 2 to 1%.

The legal environment is favorable for these shifts – meaning that state law and legal precedent allows for changes to these aspects of pension policy.

What’s unclear is whether South Carolina can shift workers’ vesting periods, because this issue has not been brought to court and there is no existing law explicitly prohibiting this change.

It is important to note that current retirees’ benefits have greater legal protection than those of active employees. Apart from reduced or eliminated COLAs, current retirees’ benefits cannot be taken away or reduced under South Carolina pension law.

Disclaimer: The information here doesn’t constitute legal advice or representation. Equable is not necessarily recommending any of the policies discussed in the infographic. Some may not work for certain states, others may not be desirable policy. Ultimately, any pension policy change should honor promises made to public workers and put them on a path to retirement security, while ensuring sustainable funding measures.