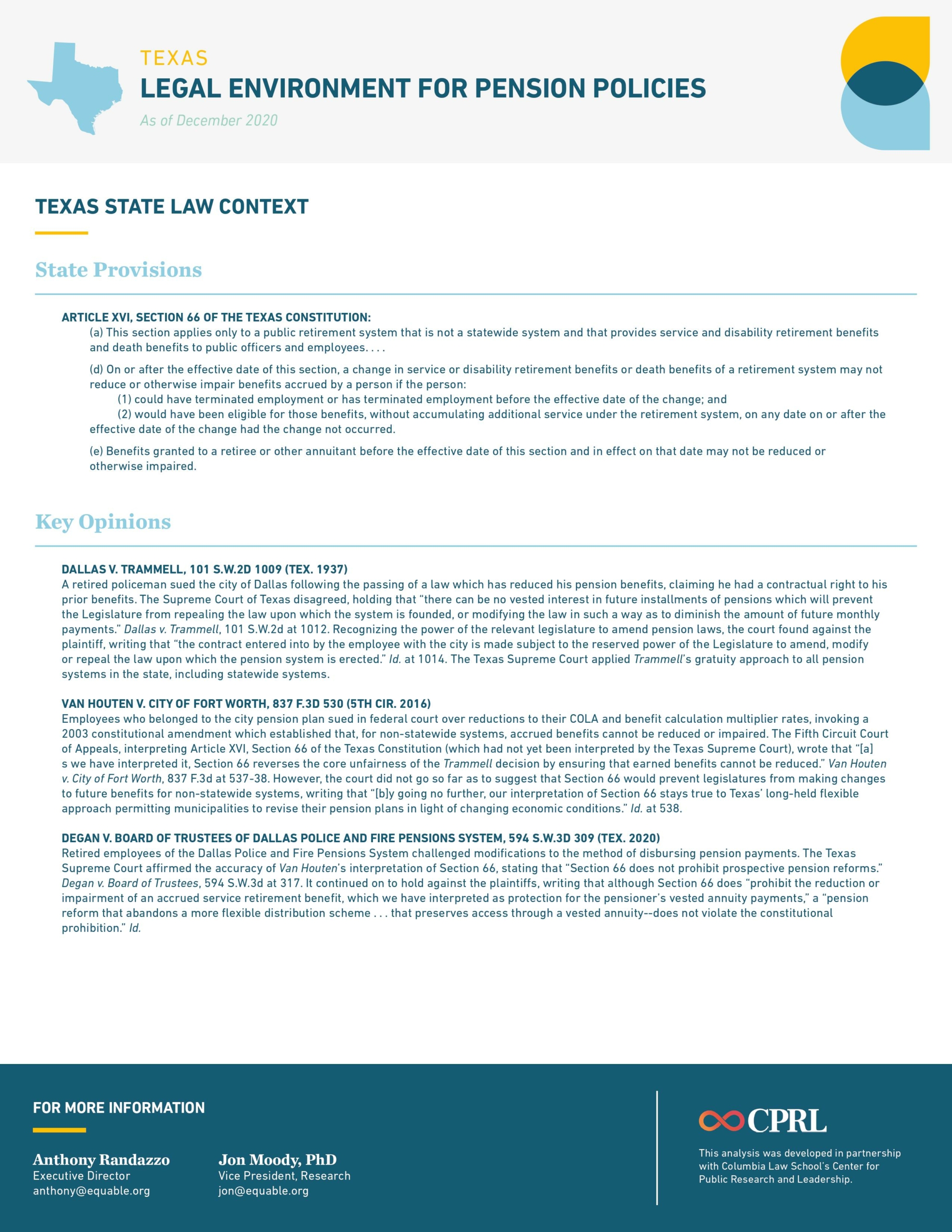

Texas teachers’, public safety officers’, and public workers’ pension benefits are entitled to certain protections under state law and affirmed by court rulings. At the same time, the state does have some legal precedent that allows them to change particular aspects of retirement benefits.

In other words, Texas pension laws allow parts of public pension benefits to be changed by future state laws, but only certain parts of those benefits.

Equable Institute partnered with Columbia Law School’s Center for Public Research and Leadership to create infographics that map states’ pension governance. Understanding the legal environment for pension policies can be confusing for both lawmakers and public workers, but illuminating legally permissible policy pathways to improve funding sustainability and ensure adequate retirement income security for states’ workforces is essential.

Understanding Texas Pension Laws

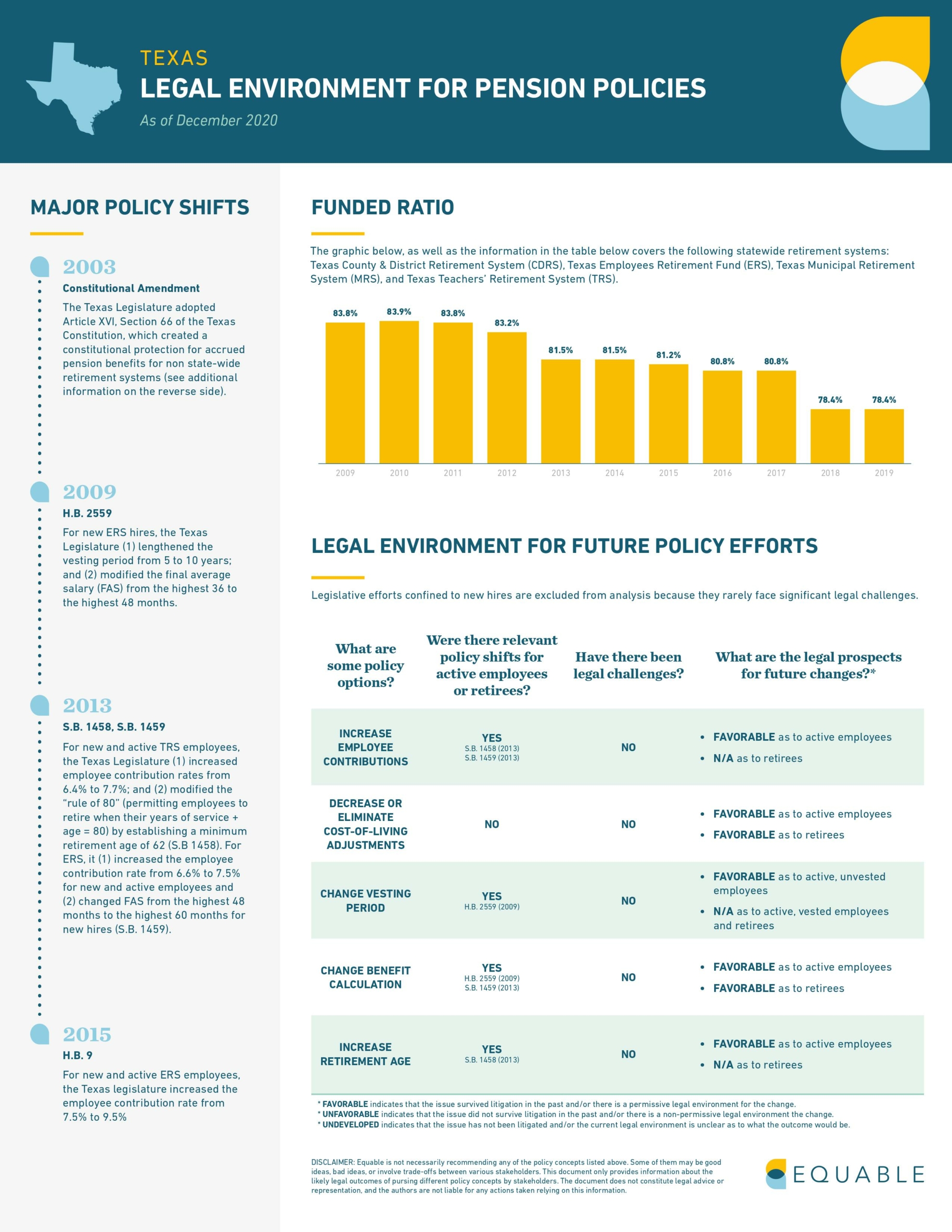

In the case of Texas, state law allows the legislature to shift workers’ vesting periods. In 2009, they did just that, lengthening vesting periods from five to 10 years. Changes have also been made to employee contribution rates in 2013 and 2015, benefit calculations, and retirement age.

It is important to note that current retirees’ benefits have greater legal protection than those of active employees. Apart from reduced or eliminated COLAs, current retirees’ benefits cannot be taken away or reduced under Texas pension law.

Disclaimer: The information here doesn’t constitute legal advice or representation. Equable is not necessarily recommending any of the policies discussed in the infographic. Some may not work for certain states, others may not be desirable policy. Ultimately, any pension policy change should honor promises made to public workers and put them on a path to retirement security, while ensuring sustainable funding measures.