Mississippi is considering changes to its retirement plan provisions for the Mississippi Public Employees Retirement System (MSPERS), as presented in Senate Bill 2439. The bill, which passed the Senate in mid-February, would replace the current “Tier 4” pension plan offered by MSPERS with a “Tier 5” hybrid plan that combines a defined benefit pension and individual defined contribution account for employees hired on or after March 1, 2026.

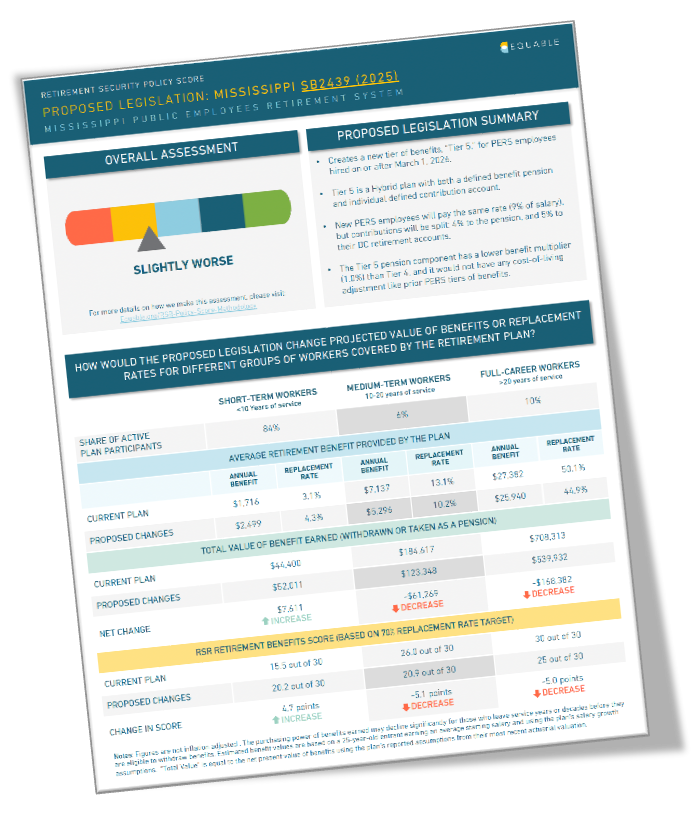

Equable Institute has analyzed the proposed changes in Mississippi Senate Bill 2439 using Retirement Security Report methodology, finding that Tier 5 as proposed in SB2439 is slightly worse overall for workers than the currently available Tier 4 pension plan. While workers with less than 10 years of service would see modest increases to their retirement benefits, the bill would result in significant losses for the longest-tenured employees (-$168,382 on average for workers with more than 20 years of service), while also failing to address the underlying fiscal sustainability challenges facing MSPERS.

DOWNLOAD THE SCORECARD

EQUABLE INSTITUTE’S ANALYSIS OF MISSISSIPPI SENATE BILL 2439

Positive Elements of the Proposed Changes in SB2439:

- The introduction of a partial defined contribution plan makes retirement benefits more portable for members who won’t remain enrolled in PERS for their whole career. The PERS board has adopted assumptions that suggest more than 4 in 5 public workers in Mississippi work fewer than 10 years, meaning this improvement could help many future workers covered by PERS.

- The benefits for Short-Term Workers (who work 10 years or less) are more generous than those offered by the current Tier 4 pension. The annual benefit is almost 50% larger and the total benefit value is more than $7,500 higher. Because this is overwhelmingly the largest segment of PERS members, Tier 5 would be a better fit for today’s more mobile workforce.

- While the proposed benefits for Medium-Term Workers (who work 10 to 20 years) and Full-Career Workers (who work 20+ years) are less than Tier 4, they are still enough that, when combined with Social Security, they will still provide a secure retirement benefit to PERS members that replaces more than 70% of pre-retirement income.

- The costs of providing Tier 5 benefits are substantially lower than the current plan offerings, which is an important consideration for a plan that was only 55.8% funded with $26 billion in unfunded liabilities in 2023. Tier 5 would be less likely to see costs rise moving forward.

Neutral Elements of the Proposed Changes in SB2439:

- Social Security benefits are estimated to replace 50% or more of PERS employees’ salaries in retirement and, when combined with the PERS benefits, Tier 5 members can still experience total replacement rates above 90%, well above the 70% target identified by Social Security and private retirement providers.

- Tier 5 increases the service requirements for early and normal retirement (which will affect some future workers), but leaves the normal retirement age at 65 which is still lower than Social Security.

Negative Elements of the Proposed Changes in SB2439:

- The elimination of inflation protection through a COLA is a significant reduction in the value of benefits from Tier 4 to the proposed Tier 5. This reduces the total value of benefits and means retiree income will be susceptible to the decay of inflation over time.

- While the costs of Tier 5 are lower than Tier 4, nearly all of the costs will be paid for by members while the vast majority of future employer contributions to PERS will just be for paying down legacy pension debt. This effectively means future worker benefits are being lowered to make it more affordable for the state to pay for unfunded liabilities.

- Tier 5 would mean a substantial reduction in the benefits earned by Medium-Term Workers and Full Career Workers. As the table shows, total benefits would be reduced by over $60,000 for Medium-Term Workers and more than $160,000 for Full Career Workers.