A key feature of defined benefit pension plans is that they offer guaranteed income for life. But unless the purchasing power of that income keeps up with inflation, the guarantee doesn’t necessary provide ensured financial security. That is why many public pensions come with cost-of-living adjustments, or COLAs.

Public pension COLAs vary in how much inflation protection they provide, and in who gets the benefit adjustments. In this article, we explain some of the different kinds of cost-of-living adjustments provided to retirees from public employee pension funds. We also provide a list of what COLAs have been offered in 2022.

The average COLA for public worker retirees across 2022 is 1.83%.[1]

This figure is well below most measures of actual price inflation in 2022. That is because many COLA policies do not match inflation, but instead have maximum rates or are linked to other factors. There are some reasonable financial reasons for this, and some years public retirees get COLAs that are actually larger than inflation. However, the net effect in 2021 and 2022 has been that public pension COLAs frequently are less than inflation.

Here is a list of U.S. public pension plans and the COLAs they’ve provided in 2022.

Compounding versus Non-Compounding COLAs

When pension plans pay out COLAs, there are two basic ways plans adjust the underlying benefit:

Compounding Benefits: This means that the base benefit gets permanently adjusted. Any future changes to benefits are added on top.

For example, someone with a $40,000 pension that gets a 2% COLA will have their base benefit increased to $40,800. The next year, if inflation means a 1.5% COLA, then the plan calculates an adjustment based on the new, higher number. So in this case, the benefit would increase to $41,412.

Non-Compounding Benefits: This means that all inflation adjustments are based on the original pension benefit value. Each year your plan increases benefits, you get to keep the adjustment from the previous year. But, the percentage increase is based on your original pension.

For example, someone with a $40,000 pension that got a 2% COLA would see $800 added on top for a total pension of $40,800. The next year, they would see a 1.5% COLA calculated based on the original $40,000 pension and an added $600 on top for a total pension of $41,200.

Three Types of Automatic COLAs

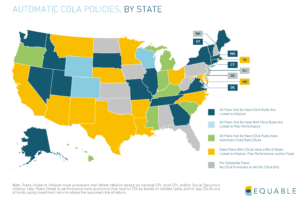

There are generally three policy frameworks for those who do have automatically granted COLAs that protect public worker pensions from inflation:

- Fixed-Rate COLAs: A pre-fixed specific percentage of benefit increase (or minimum dollar amount).

- COLAs Linked to Inflation: A percentage increase to benefits based on the national consumer price index (CPI), a local CPI, or the Social Security inflation rate. The actual amount is typically “up to” a maximum rate, such as 2% or 3%.

- COLAs Linked to Plan Performance: A percentage increase to benefits that is dependent on the funded ratio and/or investment performance of the underlying pension plan. The actual amount is also typically “up to” a maximum rate. But, the specific provisions around plan performance determine the maximum rate. For example, the maximum COLA rate may be cut in half or suspended if the pension fund is under 80%.

Some state pension funds have inflation adjustments linked to both inflation and pension plan performance.

Ad Hoc Cost-of-Living Adjustments

There are a number of state pension plans that do not provide consistent inflation protection. Some of these states have no legal provisions to offer COLAs. Other states only payout COLAs if the legislature authorizes the benefit adjustment. These are called “ad hoc” COLA benefits because they aren’t legally required and they are heavily dependent on local politics and legislative budgets.