Share

State of Pensions 2022

Negative financial returns expose how vulnerable state and local plans are to market volatility.

What is the State of Pensions in 2022?

This an annual report on the financial status of state and local public pension systems, put into a historic context. State and local governments face a wide range of challenges in general – and some of the largest are growing and unpredictable pension costs. The scale and effects of these challenges are best understood by considering the multi-decade financial trends and funding policy decisions that have brought public sector retirement systems to this moment.

There should be little surprise that America’s pension funds have taken a financial hit this year, swinging backwards the year following some of the best investment returns in history. Massive returns for public and private equity in 2021 didn’t clearly align with any kind of obvious market fundamentals signaling a persistent future of growth. The volatility and fragility of the past few years point to the clear reality: state and local retirement systems collectively are not going to invest their way out of their poor funded status. The primary path forward for most pension funds with fragile or distressed funded ratios will likely require assumption changes and contribution increases.

Positive Trends

Negative Trends

The Effect of On-Going Global Conflict

Efforts to divest from Russian assets were formally adopted in 23 states, including:

The primary effect of the Russian-Ukraine war has been to put downward pressure on financial markets generally.

National Trends

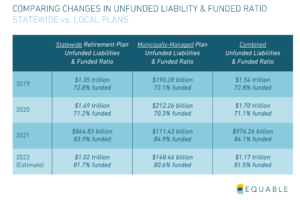

Within the Trends: State & Local

Among all statewide plans, 153 out of 167 have reported their final 2021 figures. Among local plans 42 out of 61 have reported their 2021 data.

Of the 94 plans with a funded ratio above 90% in 2021 reported data, we estimate 23 will decline into the 80%s or 70%s.

We also estimate there will be 3 plans that fall from Fragile into Distressed funded status based on 2022 returns.

A pension plan’s funded ratio might have dipped because the pension board adopted more realistic actuarial assumptions.

Spotlight: State of Inflation Protection

Inflation protection is important for ensuring benefits continue to provide retirement income security as intended.

Looking to the Future