Share

State of Pensions 2021

A year of epic investment returns brings both good news and serious warnings for U.S. statewide pension plans

What is the State of Pensions in 2021?

So what are the trends in public pension funding in 2021?

Positive Trends

Negative Trends

The National Trends

Public Pension Trends to Watch Beyond 2021

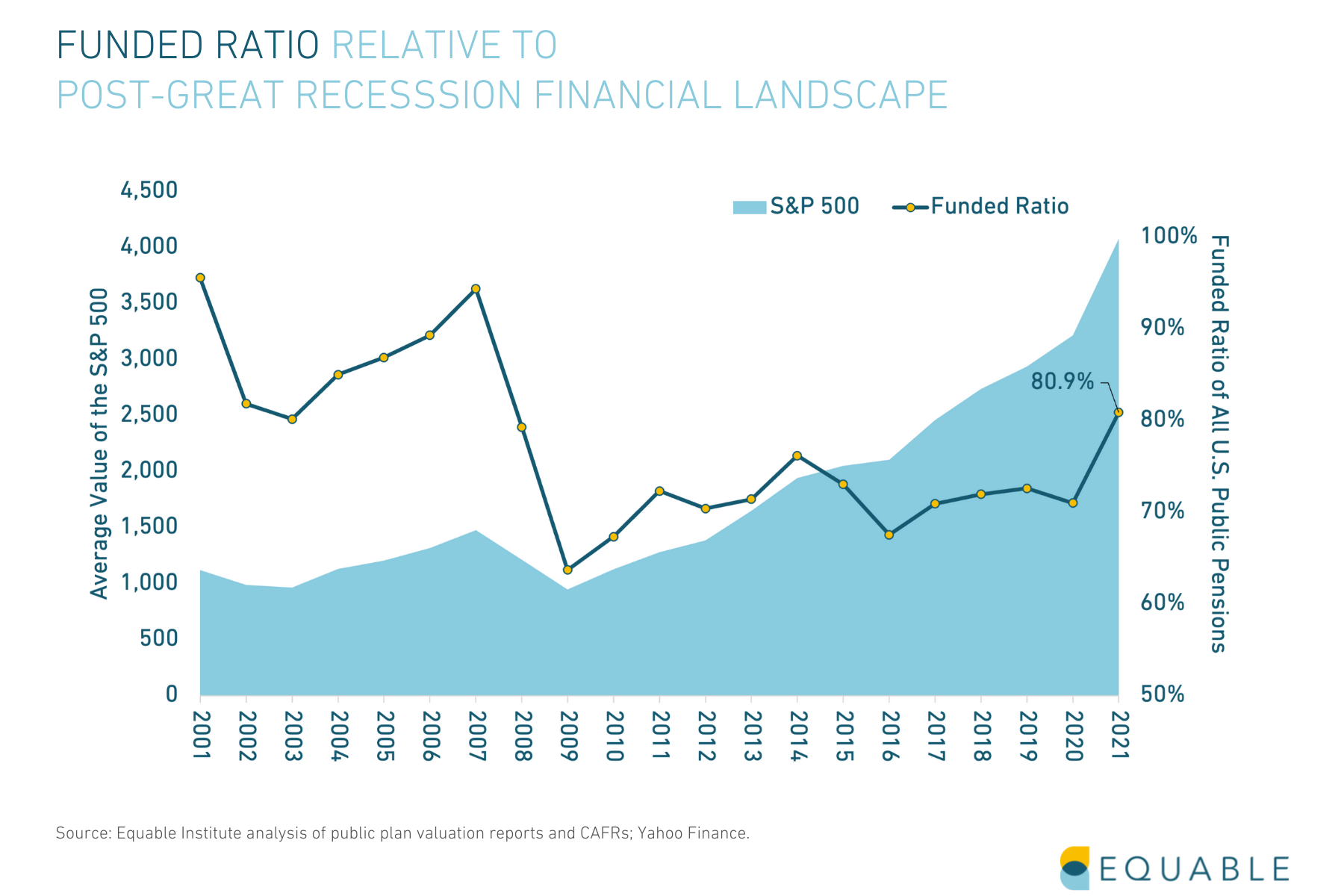

Within The Trends: Funded Status

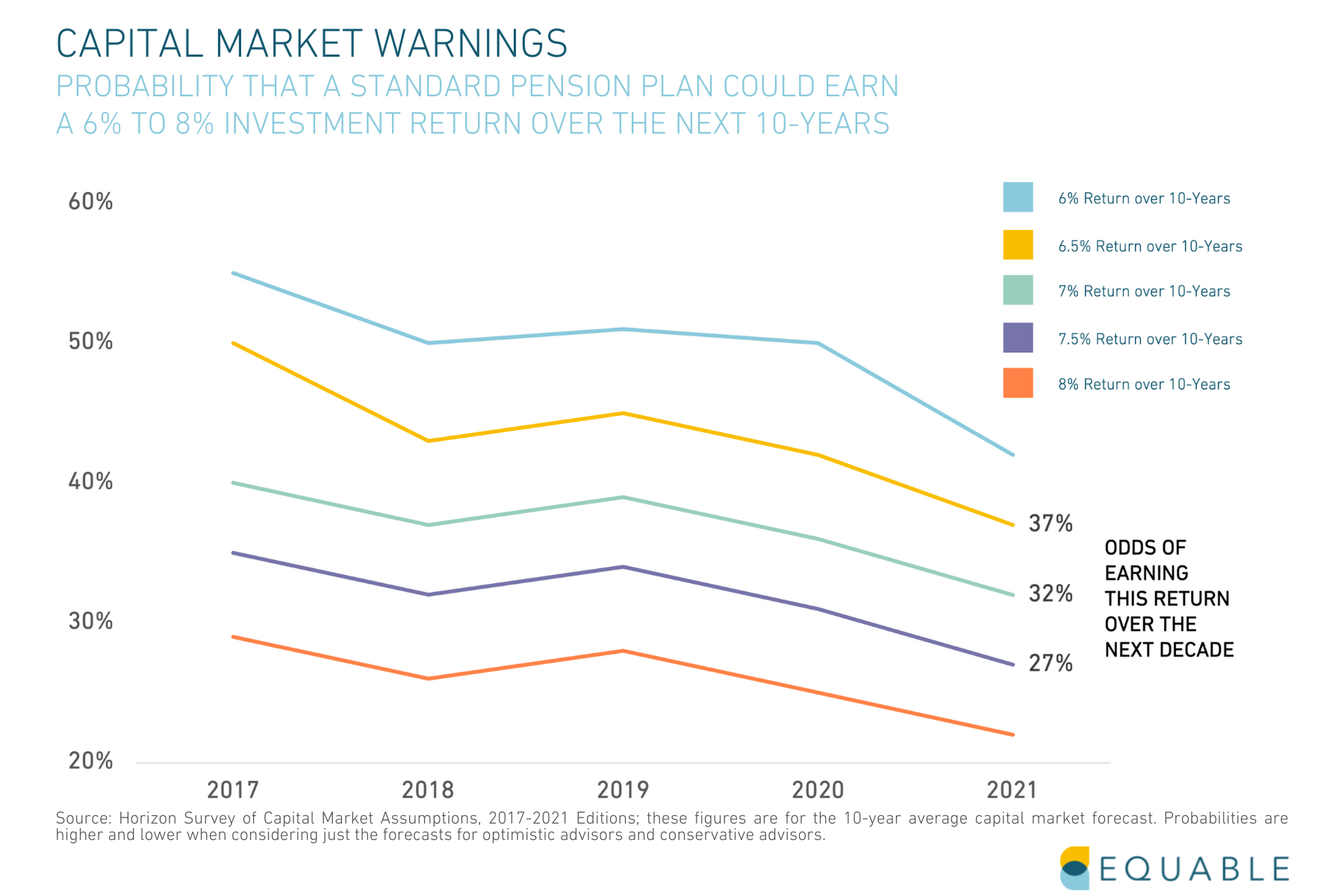

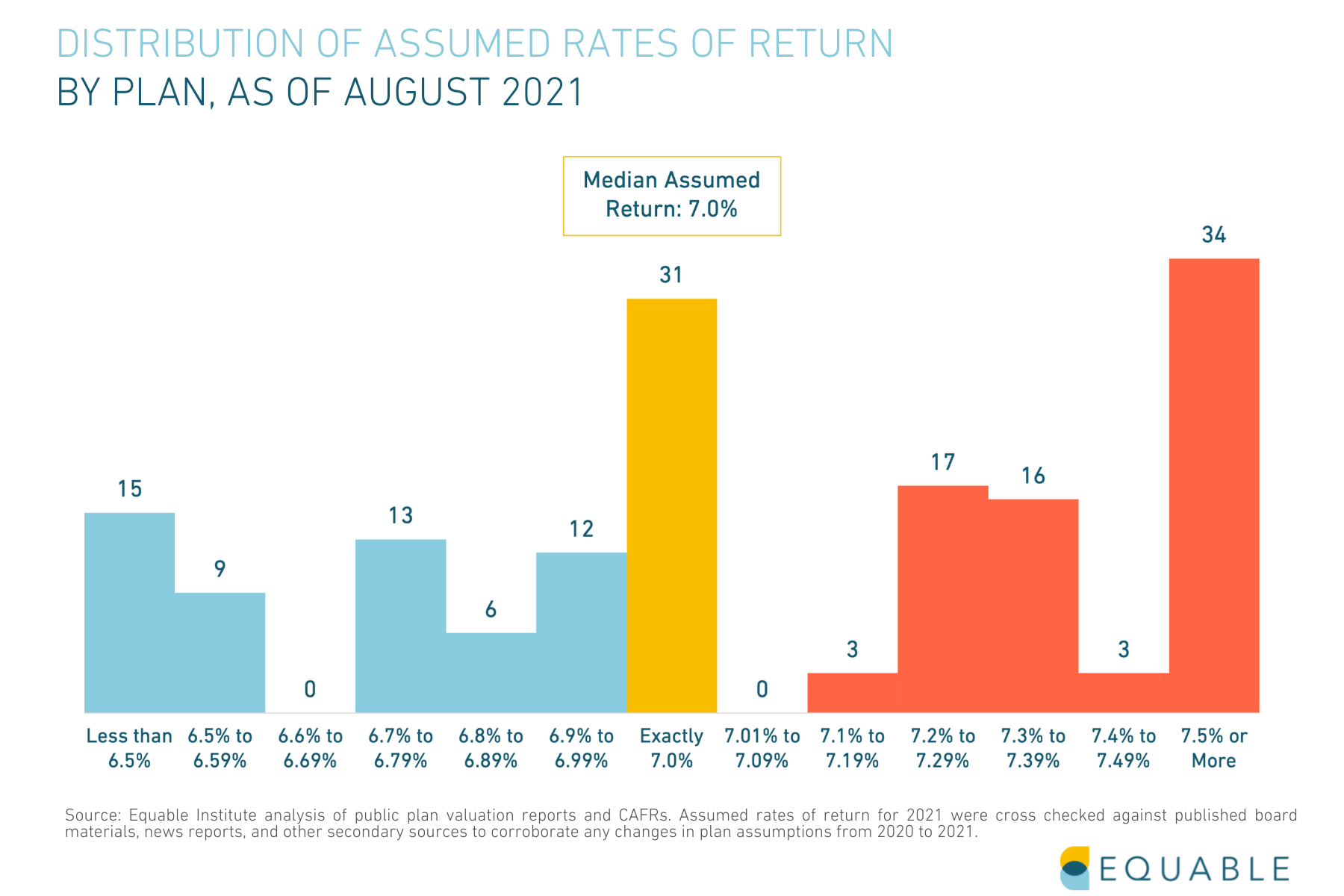

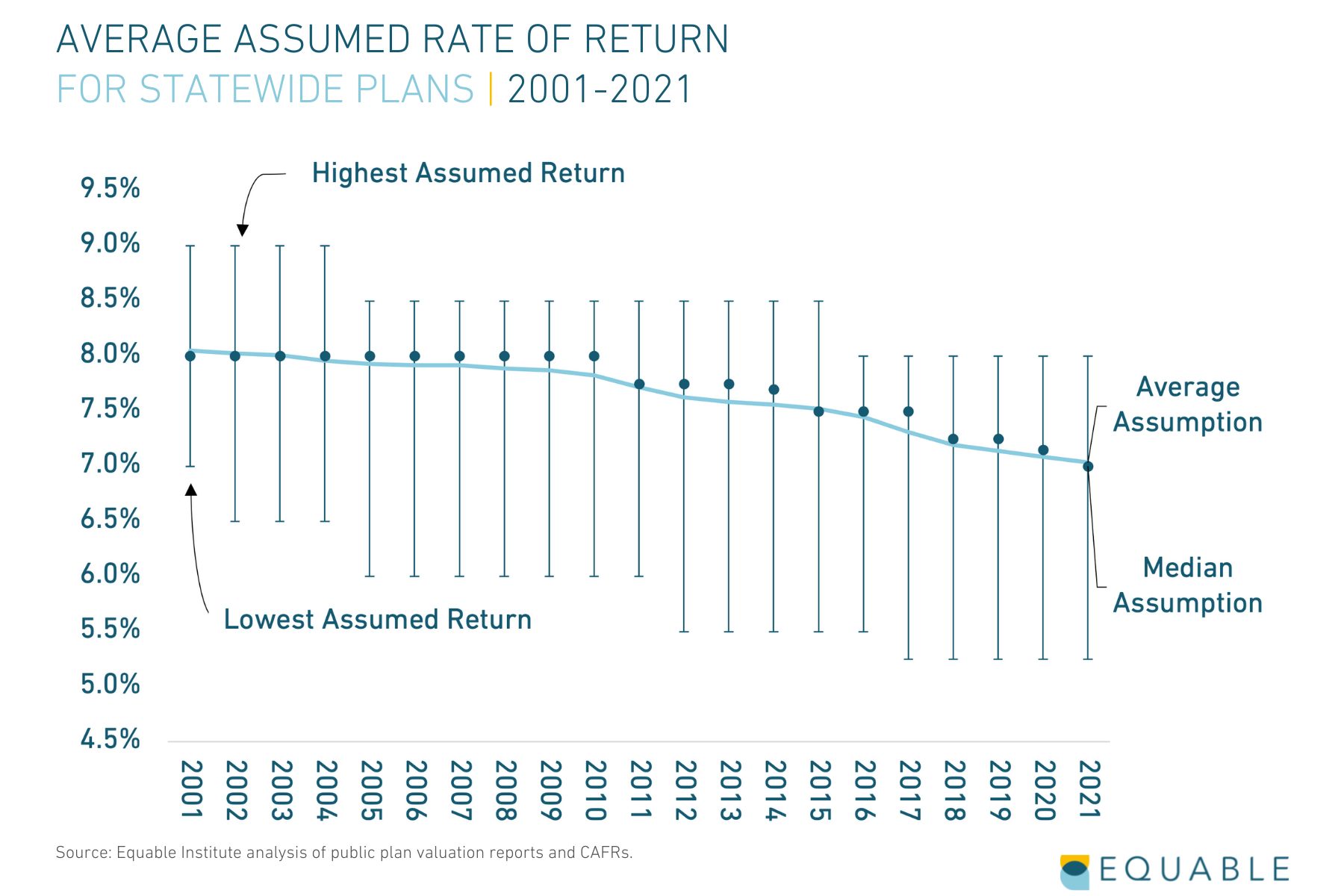

Within The Trends: Investment Assumptions

Within The Trends: Contribution Policy

Within The Trends: Cash Flows and Maturing Plans

Within the Trends: The State of Benefits

Looking to the Future

We're here to help. Contact us for more information.

Additional Resources

State of Pensions 2021 Downloadable Data

Interested in exploring our data set? Download the raw data from our December update here.

Read More

December Update: Funded Ratio History Downloadable Graphics

Looking for your state's funded ratio history graphic from our December 2021 Update? Download it here.

Read More

State of Pensions 2021: FAQ

Have questions about our findings and methodology? Read our FAQ.

Read More

Policy Solutions for States

Explore policy options that states can implement to address the public pension policy challenges highlighted in State of Pensions 2021.

Read More

Solutions for Stakeholders

Stakeholder engagement is key to effective public pension policy improvements. Here's what labor leaders, local officials and members can do to take action.

Read More

State of Pensions 2021 Explained: Unfunded Liabilities as a Share of State Economic Output

An overview on why looking at unfunded liabilities as a share of state GPD and spending are useful metrics to consider pension plan health.

Read More

Explore More

Equable Institute on June 24 launched the first edition of the Retirement Security Report, an interactive digital report that evaluates the quality of public retirement […]

Equable Institute’s Retirement Security Report evaluated the quality and value of 335 statewide retirement plans in the United States using important retirement plan design metrics […]

U.S statewide pension funds entered the COVID-19 recession profoundly weaker than they were financially going into the Great Recession, a new report on […]