Equable Institute has re-issued Retirement Security Policy Scorecards for Alaska House Bill 78 (HB78). First introduced in 2025, the latest version of the bill would close the current Defined Contribution plan and replace it with a Defined Benefit Pension Plan for new members of the Alaska Public Employees’ Retirement System (AK PERS) and Alaska Teachers’ Retirement System (AK TRS). Existing PERS and TRS defined contribution plan members would have a one-time, 180-day election period to opt-in to the new pension plan. The original version of the bill proposed leaving the current Defined Contribution plan in place and offering a new Defined Benefit Pension plan as an option for new members.

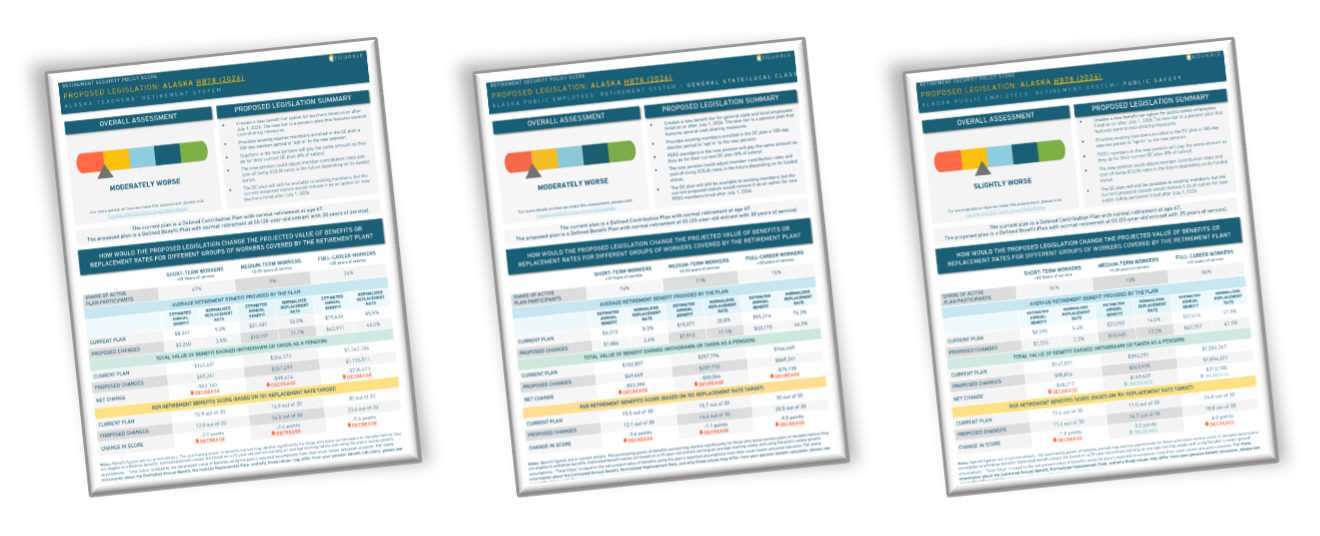

Equable’s assessment finds that retirement benefits would be moderately worse overall for workers under the current proposal.

According to the assessment, the proposed Pension Plan would provide lower overall valued retirement benefits to workers of all tenures. Full-career employees (those with more than 20 years of service) would have the most significantly lower benefit values: $75,128 less in total lifetime benefits for the average full-career worker enrolled in Alaska PERS, $235,673 less in the total lifetime value of retirement benefits for full-career members of Alaska TRS.

To illuminate the impact on different workers across the state, Equable has produced three scorecards for this bill: one for educators and other employees enrolled in the Teacher Retirement System, one for public safety employees enrolled in PERS, and one for general employees enrolled in PERS.

DOWNLOAD THE TEACHER SCORECARD

DOWNLOAD THE PUBLIC SAFETY SCORECARD

DOWNLOAD THE GENERAL SCORECARD

EQUABLE INSTITUTE’S ANALYSIS OF ALASKA HOUSE BILL 78

Positive Elements of Alaska House Bill 78:

-

The new proposed pension includes many of the best practices in funding policy, including risk sharing policies that both increase employer and employee contributions if the plan falls below 90% funded and reduce contributions if funding improves.

-

Pension plans offer guaranteed income, which is preferred by some public employees even if it means the total benefit values would be less than could be earned through a DC plan.

-

While the estimated benefits for the new pension are worse than the existing defined contribution plan (see prior page), those estimates operate on the assumption that markets remain stable, and the DC plan earns a consistent return. By contrast, the proposed pension would provide retirement income that is stable, predictable, and guaranteed.

-

The variable multiplier for the proposed pension increases the longer a member is in the system, rewarding those who stay in Alaska and continue to remain in public service. In theory, this could support retention, which is a primary objective of lawmakers considering this plan.

Negative Elements of Alaska House Bill 78:

-

While the funding policies use many best practices, the proposed pension does NOT include changes to the existing actuarial assumptions for PERS, which increases the chance of unfunded liabilities accruing and a contribution rate increase.

-

The value of the proposed pension benefit is estimated to be significantly less for every stage of a general state or local employee’s career. The total estimated value of the benefit is roughly $50,000 less for Short-Term and Medium-Term Workers, and roughly $75,000 less for a Full-Career Worker.

-

The pension would offer reduced portability when compared to the current defined contribution plan. For those who might leave PERS without working a full career, this means the new plan might not be right for them.

-

Allowing existing members to buy out of their DC plans into a pension plan could result in unfunded liabilities (and an increase in contribution rates), if the value of benefits being purchased is not calculated using appropriate actuarial assumptions.

-

Removing the DC plan as an option for new members reduces PERS’s ability to provide meaningful benefits to all of its members. Offering a choice between the new pension and the existing DC plan allows PERS members to decide which benefit best fits their needs, whether that is portability and flexibility for shorter-term members or a guaranteed income should they remain with PERS their whole career.