Download The Case Study | Calm Amid the Chaos: Wisconsin’s Pension System and the 2008 Financial Crisis

Between September and December of 2008, as investors ran for cover in the wake of the subprime and banking crises, the stock market had five of the ten biggest single-day drops in its history. For anyone who was managing a retirement portfolio it was a staggering, terrifying moment.

At that time Bob Conlin was not managing a retirement portfolio. He was managing 550,000 retirement portfolios. The Wisconsin Retirement System’s portfolios.

You can hear the strain in his voice when he recalls that Fall: “2008 was a painfully long year.”

Today, Conlin is the chief executive for Wisconsin’s statewide public employee retirement system, the Department of Employee Trust Funds, more commonly known as the Wisconsin Retirement System (WRS). Back in 2008, when all they could do was watch as the carnage unfolded, he was second-in-command of WRS.

“The second half of the year we were just watching the losses pile up,” he says. “We couldn’t do a thing to stop it.”[1]

Conlin recognized how serious that financial slide was, but he also knew something else. When Wisconsin’s public pension system was redesigned in the 1980s, merging several systems into what WRS is today, its architects had planned for events of this magnitude. And they had left him a “break glass in case of emergency” solution for getting through fiscal challenges without compromising the integrity of the system. It wouldn’t be much fun, but the alternatives — defaulting on their obligations to retirees, or spiraling into financial turmoil that could bankrupt the state — were far worse.

Pension systems in the U.S. have been around for more than 100 years. After that long you’d think there would be a standard way to run one, but there isn’t. There isn’t even much federal regulation governing state pension fund management. Consequently, each state structures their systems a bit differently, using a variety of accounting rules, and a wide range of funding practices. To make comparisons even trickier, the U.S. economy has gone through several radical shifts during the 20th century — from the Great Depression, to the economic expansion after WWII, to the tech boom of the 1990s and 2000s — all of which affected different states in different ways. The rate of change has only sped up into the 21st century. With all these variables moving at once, it’s been hard to pinpoint the best practices that ensure public retirement systems can weather fiscal storms.

Until 2008, that is.

There’s nothing like a crisis to show where the weak points are. And the financial carnage of 2008 revealed a host of flaws in state and local funds across the country. The crash and ensuing recession were the most significant stress tests public retirement systems have ever faced. And they give us our clearest window yet into the policies and practices that can safeguard retirement funds, and keep them from affecting taxpayers and compromising state budgets.

Many states were already facing unfunded pension liabilities going into 2008. The economic recession that

year resulted in lower tax revenues for states, which ultimately led some to skimp on their required pension contributions. On top of all that were the horrendous losses suffered by the pension funds themselves when financial markets took a nosedive. Unfunded liabilities spiked, and many states dug themselves into holes they are still trying to recover from.

Today, 34 states have accumulated pension debt that is more than their full budget in a given year. And there are 18 pension plans with funding shortfalls that are more than 5% of state GDP, a common measure of economic activity.[2] These outsized funding requirements create significant downstream effects as pension expenditures begin to crowd out essential government services such as infrastructure, public safety, and education resource equity.

Not all states had such grim outcomes. Those with healthy plans and responsive pension boards — such as South Dakota and Tennessee — took big hits and ran deficits for a while, but after putting emergency measures in place, were able to get back on track.

But one state never got off track in the first place: Wisconsin.

“When the books closed at the end of 2008, the losses were pretty significant,” Conlin recalls. “We knew the board was going to have to do something.” The only trouble was, the something that needed doing had never been done before. It involved an unassuming-sounding mechanism called the “Annuity Adjustment.” We’ll come back around to describing exactly what this mechanism is, but in short it is a policy tool that allows pension benefits in Wisconsin to be increased or decreased based on the state’s investment performance. The WRS executive team and board of trustees knew some people wouldn’t be happy with them for triggering this tool, but Wall Street had hit an iceberg. And when that happens, you get into whatever lifeboat you have.

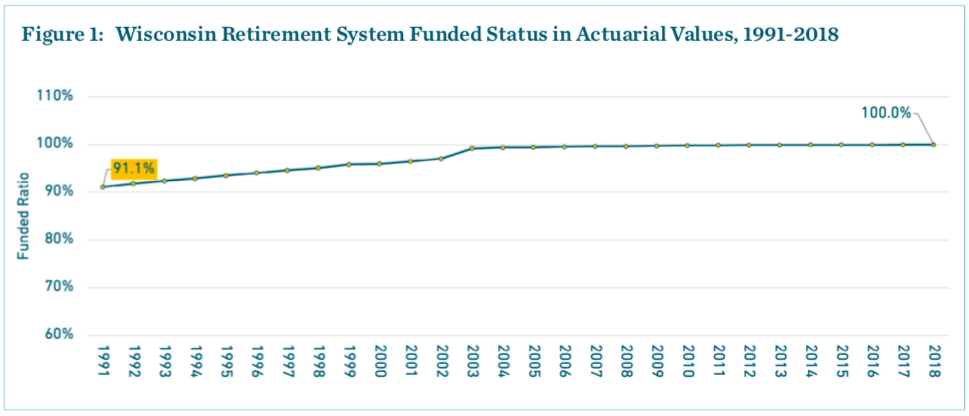

The story of how the WRS remained 100% funded throughout the crisis and its aftermath involves both prescient policy decisions made decades ago, as well as the firm bureaucratic resolve of the WRS’s administrators to use their emergency tools when the situation dictated, regardless of any potential blowback. Here’s how they did it.

1. The Wisconsin Retirement System Went into the Crisis with Strong Fundamentals

It would be hard for any pension system to achieve or maintain solvency without strong funding discipline, solid investing practices, and reasonable actuarial projections. Wisconsin has had these fundamentals locked down for quite some time.

For starters, Wisconsin’s statutes require public employers to pay 100% of their share of pension costs every year without skipping a payment, just as employees are required to do. “It never hurts to pay what you’re supposed to pay and pay it on time,” says Conlin. “If you don’t have strong funding discipline, all the other things we do won’t help. But if you do have the funding discipline, they can help a lot.”

Wisconsin also makes conservative assumptions about the performance of its investment portfolio (at least, relative to most other public pensions). In 2010, the median assumed rate of return for state pension plans nationally stood at 8%, an overly optimistic target that contributed to pension woes across the country. Wisconsin’s had been at 7.8%, but in light of the financial crisis, they lowered it significantly, all the way to 7.2%. At the end of 2018, with the national average assumed return at 7.25%, they lowered their rate again to 7.0%. Not having a pollyannaish outlook about market performance makes it easier for the WRS to hit its goals and deliver on its promises.[3]

Finally, Wisconsin gives themselves the best shot at accurately calculating their pension contribution rates each year, by assiduously monitoring their actuarial assumptions and how they square with reality. As in most states, the pension board hires actuaries to do annual spot checks on its assumptions, and every five years does a deep dive on the way real world performance is stacking up against predicted models. In addition, however, Wisconsin puts together an interim “experience report” every three years to make sure their long-term assumptions are lining up with the real world. States that wait five (or even ten) years to do these checkups often allow problems to fester.

More frequent analysis means more frequent adjustments, which in turn means smaller adjustments. “Small changes are more palatable, because they are easier for employers and employees to budget for,” says Conlin. “Making a 0.2% change to contributions every year is preferable to waiting 5 or 10 years and then making a 5% change.”

2. The Wisconsin Retirement System’s Board is Insulated From Politics

If smaller contribution changes are preferable, making frequent trips to the state capitol to ask for additional funds is most definitely not.

In many states, the pension board must go to the state legislature every year to get approval for pension contributions. This is fine in fat years, when politicians get to spread money around freely. But in lean years it can set up a conflict of interest, forcing politicians to do the unpopular (but fiscally responsible) thing — i.e. increase local employer contributions, raise employee contributions, modify benefit adjustments, or use tax money to make up the difference.

“Some of my colleagues in other states have everything set in the statutes. That means they need to get legislative permission to change anything,” Conlin notes. “That just adds a political element to it. Who wants to vote for a contribution increase or a benefit reduction?”

It’s not that hard to see why so many state pension problems get pushed into the future: incentives for state legislatures are typically lined up to favor political optics and near-term budgeting needs.

To make matters worse, most elected officials are not pension policy experts. While legislative oversight of public programs is vitally important, the frequent turnover of individuals providing that oversight means it’s a rare exception when members of the legislature have a granular understanding of how a pension system works or the complex actuarial science determining how it is funded.

Wisconsin solved for both the perverse political incentives (along with the scarcity of trained economists in the legislature) by taking micro-level decision-making on pensions out of politicians’ hands, while still giving them ample opportunity to provide oversight. Wisconsin gives the WRS significant independence when it comes to decisions regarding contribution rates and benefit adjustments. This mostly insulates the WRS’s board members — and by extension its public employees — from the vagaries of year-to-year politics.

Wisconsin’s laws simply mandate that public agencies pay 100% of their actuarially determined contribution (ADC) every year. Once the ADC has been calculated by the WRS’s actuaries, it becomes a part of the budget. The legislature still has oversight duties, but does not need to pass an annual appropriation to cover its obligation. Because the ADC is put in the state budget by default, elected officials would have to affirmatively draft and vote in legislation to defund public pensions — a decision that would come with its own set of unpleasant political optics.

In the end, however, the best argument for Wisconsin legislature taking a hands-off approach is the WRS track record. “Success is always helpful,” says Conlin. “If you’re not constantly in crisis, you aren’t a target for fixing. That makes it easier for the legislature to be more hands off.”

The WRS’s independence has worked out to be a true win-win. Politicians aren’t forced to vote for things that might make them unpopular (or that they don’t understand), and the experts within the pension board have the freedom to make decisions based on the math, without having to worry about selling them to a jumpy legislature. As a result, the natural upward/downward, good news/bad news cycles of the economy are costed into the system, instead of ending up as political hot potatoes.

3. The Wisconsin Retirement System’s Variable Annuity Adjustment

But while strong fundamentals and political independence were important factors that put the WRS on solid footing going into the 2008 crisis, they weren’t what kept the system solvent in the face of a catastrophic stock market collapse.

Credit for that trick goes to a unique feature of the Wisconsin system called the Annuity Adjustment (AA). This financial lever, which Conlin calls “the key to our long-term fiscal performance,” gives the pension board a powerful tool for keeping the fund on track by using surplus gains in prosperous periods to provide much-needed cushioning in lean years.

In the early 1970s there were many retirement plans spread across Wisconsin, all with varying states of stability and funding. Recognizing that this situation put many Wisconsin residents in precarious positions regarding retirement, state leaders consolidated most of these plans into a single, statewide system with as many beneficial, future-proofing features as possible. Max Sullivan and Gary Gates, the then-director and deputy director of Wisconsin’s retirement system, put forward the idea of an annual benefit adjustment that would be based on investment performance.

“Whether it was his idea or my idea or it came from both of our brains — I don’t think I know of any other place that did it like that,” Gates told the Milwaukee Journal-Sentinel. The core of their idea was to establish a shared- risk model for benefits that could provide a relief valve in the event of a severe financial crisis or any other kind of fiscal pressure on the retirement system. Whether it was Sullivan or Gates that dreamed up the concept, the Annuity Adjustment turned out to be exactly the kind of tool Bob Conlin and WRS needed 50 years later.

In retirement, every WRS participant is guaranteed a minimum monthly check for life.[4] That’s standard for any pension plan — but that’s not all. In a given year, if the 5-year “smoothed” investment return is above what was expected, the WRS board can choose to increase pension payouts above the base benefit. Every year the WRS board evaluates its investment returns and determines how much they can increase pension checks. Critically, however, in lean times they can also decrease the amount they pay out — but not below the guaranteed minimum. The AA can be an adjustment up, or down.

Here’s How the Wisconsin Annuity Adjustments Work:

Step 1: WRS establishes an assumed rate of return for the assets of active employees, and sets a

separate minimum targeted investment returns for retiree funds.

- For most of the 2000s, the assumed rate of return was 7.8% and the target for retiree funds was a 5.8% return on investments.

- In the years since the financial crisis the assumed return has been lowered twice, and as of 2019 the WRS assumed rate of return is 7%. As a result, the target for retiree funds is now 5%.

Step 2: WRS measures investment returns using a 5-year “smoothing” period. This means that each year’s actual investment return is spread out over five years.

Step 3: WRS determines whether the 5-year smoothed investment return is higher than the targeted rates of return.

- If investment returns are greater than the lower threshold (the 5% value today), then the WRS board can consider increasing pension benefits by adjusting up the variable annuity. These “positive adjustments” are possible because the assets of retirees have exceeded the targeted increase in assets.

- If investment returns exceed the primary assumed rate of return for active employees (the 7% return today), then the WRS board can lower the state’s contribution rates. This is because the policies that determine pension contributions are built on some assumed rate of return.

Negative Adjustments:

- In years where investment losses are significant, and the smoothed value of investment returns is less than targeted, then the WRS board can consider reducing the value of annuities (a negative annuity adjustment) and/or increasing contribution rates.

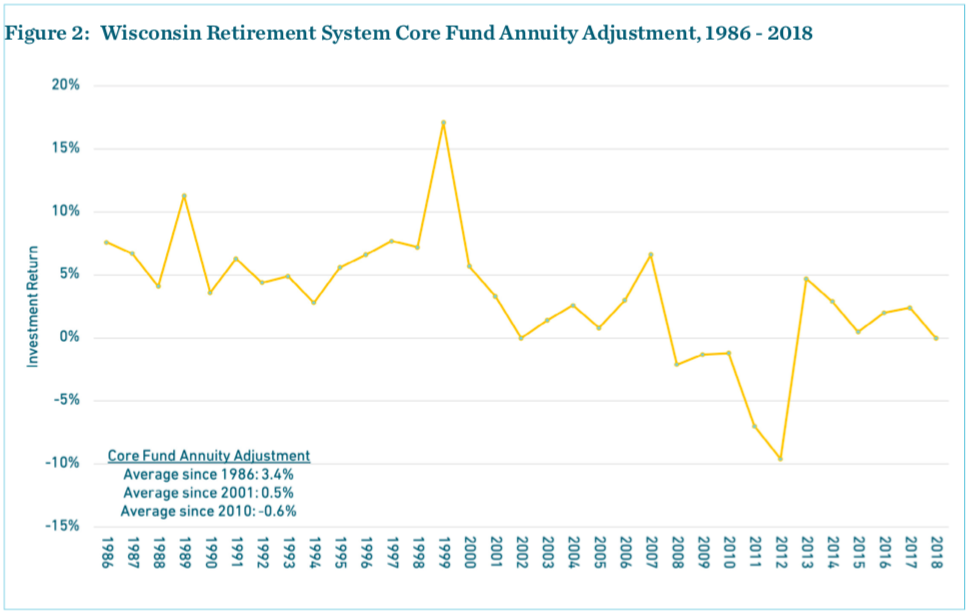

In the almost 40 years between the creation of the AA and the financial crisis, the WRS board had never needed to make a negative Annuity Adjustment — a testament to the system’s overall health. There were years of poor investment returns along the way, but either the 5-year smoothing process was able to even them out, or a funding shortfall could be quickly patched using slightly increased contributions.

Over time, the value of continual upward pension adjustments created by the AA was significant. “When the financial crisis began, we had many retirees who had seen their starting amount double or even close to triple during their retirement,” says Conlin.

But the losses at the end of 2008 were like nothing WRS had ever dealt with before. Fortunately for the state, the WRS board was able to use its emergency lever and do its first-ever negative annuity adjustment. People weren’t jumping for joy about getting less money in their pension checks, but the system remained both stable and 100% funded.

With the Annuity Adjustment feature, Wisconsin’s public retirees get three benefits at once. They’re guaranteed a minimum benefit they can count on. They get to share in the gains when the stock market is good. And they’re assured that their system can recover when the market tanks. Wisconsin employees and retirees share the pain when things are tough, but they also share the reward when things are good. Any changes up or down are done gradually so as to not shock people on market downswings, and to protect the health of the system on the upswings.

Even with the years of negative adjustments which followed the financial crisis, if you average the AA from 1982 to now, it has returned around a 3.9% annual adjustment to the base benefit. This represents significantly more value over the long haul than a typical 2% “cost-of-living adjustment” used by many states, while simultaneously providing a buffer for the overall health of the system.

As Conlin puts it, “it’s not a magic bullet, but it gives you more time to weather bad markets. And your first resort is not to the taxpayer.”

4. The Aftermath

It’s one thing to have an emergency solution. It’s another to actually break the glass and use it. And in this case that meant telling 144,000 people they’d be getting less money in their pension checks.[5]

“It’s not easy telling 85 year-olds they are going to get less money,” Conlin admits.

Ultimately, however, the WRS board determined that not only was a negative adjustment justified, it was necessary for the long-term health of the system. The only thing left to do was to make sure people understood what was happening.

“Communication was a key aspect of it,” says Conlin, recalling the turmoil of 2008. “When the books closed that year the losses were pretty significant. Everyone read the numbers and the rules a bunch of times hoping to see something else, but we were looking at investment losses above 20%. At the end of our analysis, there were no conflicting opinions on what should be done. At that point we shifted our focus to communicating. Making sure people understood how the system works and reminding them that what goes up can also come down.”

The financial bedlam happening in other states helped make the WRS’s case. “We had to reduce retiree benefits for 5 straight years and there was some grousing about it. But when people started looking around and seeing what was happening in other systems, they understood why we were doing this.”

They didn’t have to look far. Chicago (just 150 miles south of Madison, WI) couldn’t shift benefits at all — not even temporary reductions to cost-of-living adjustments. This led to spiking pension costs in the city that forced cuts to public safety resources, and threatened the solvency of its water system. To the east of Wisconsin across Lake Michigan, the city of Detroit was forced into bankruptcy, in part because of surging pension debt payments. Meanwhile, Michigan’s statewide pension system for teachers experienced a severe spike in required contributions. To this day, more than 30 cents of every dollar paid to educators goes toward backfilling the shortfall in Michigan teacher pension assets.

Despite the WRS’s relative good fortune, Conlin’s office still heard from their share of people who were unhappy about the solution. He relates a story of one retiree who called up to ask what was going on. Conlin reminded him of how the system works, that nobody’s benefit was being cut below the minimum, and that everyone had been told all along that something like this could happen. The man’s response: “Well, sure, you told us. But we didn’t really believe you.”

The WRS’s 5-year smoothing model spread the massive losses in 2008 over the following five years, meaning each year’s adjustments were far smaller than if taken all at once. On the downside, however, that same smoothing meant many retirees were still having their benefits adjusted downward well after the stock market had fully recovered. The logic of this trade-off is clear — taking all of 2008’s losses in a single year would have resulted in severe benefit reductions, funding shortfalls, and more. But that didn’t make it any easier to take when people saw the country return to prosperity, without a corresponding uptick in their pension checks.

It’s important to remember that the only monies being pulled back by WRS were additional dollars retirees had been receiving, over and above their basic pension payments thanks to the AA.

Moreover, the retirees still seeing benefit reductions five years later were those who’d benefited the most from the WRS’s good governance. “While it affected those people the most,” says Conlin, “they were also the ones who had gained the most.”

In 2014 the AA finally did tick back up. And it did so with gusto, delivering a 4.7% positive annuity adjustment. And though there’s been significant volatility in the markets since then, no further negative adjustments have been necessary.

Conclusions

The AA isn’t the only factor that has made the WRS so successful. If the system hadn’t entered 2008 with solid fundamentals, a large number of financial buffers, and a governance structure that insulates its pension board decisions from politics, it could have been a very different story. In other words, Wisconsin was already doing everything right and they had a mechanism for absorbing extreme financial events. That makes WRS something of a unicorn. And unicorns, should you be lucky enough to find one, are worth studying.

The Wisconsin Retirement System offers stable, sustainable retirements for the state’s public employees. The pension plan has been 100% funded since 2001. This stands in stark contrast to the rest of the country. In 2001, most states’ pension plans were fully funded. Today there are only four states with pension funds near 100% and the national average funded status is just 73%.

Success at WRS comes from the intersection of several factors. The plan is undergirded by strong fundamentals including exemplary funding discipline, and conservative forecasting. Because plan administrators are allowed

to operate independently and without political interference, qualified actuaries and experts make most decisions about how to balance the system, and aligned incentives guide those decisions. Finally, the variable Annuity Adjustment gives the WRS board the ability to both distribute excess gains responsibly and pull back resources as needed in a crisis. An emphasis on transparency and communication makes sure plan participants understand what is happening and that the board is operating in good faith.

Ultimately, Wisconsin Retirement System’s ability to absorb financial chaos without stumbling is a direct result of decisions made more than 50 years ago by its founders. The architects of WRS didn’t create these tools because they thought they could predict the future. They created them because they affirmatively knew they could not predict the future. “They were extremely prescient,” Conlin notes. “They knew this system would have to operate in the real world and were very forward-thinking about what might happen. They baked that understanding in from the get-go.”

Wisconsin Retirement System’s Recipe for Funding Success

1. Paying the Pension Bill

- Government employers, including the state, pay 100% of the Actuarially Determined Contribution every year.

- The WRS board performs frequent audits of its actuarial assumptions for accuracy, every three years.

2. Conservative Investment Practices

- The Wisconsin Retirement System board has historically used a relatively conservative assumed rate of return, compared to the national average.

3. Political Independence

- The WRS board has authority to determine contribution rates, which are automatically placed in the state budget.

- While the legislature can choose to engage with funding policy decisions, benefit adjustments, or actuarial assumptions, the default action is for WRS boards to manage these choices, reducing the incentives for politically driven behavior.

4. Shared Risk

- When investments are strong, WRS shares the returns with retirees in the form of annual increases to the value of their benefits, called Annual Adjustments.

- If investment returns are weak, or if there is a sharp set of losses, then the Wisconsin Retirement System board can roll back some of these increases.

- All retirees have a minimum benefit level that can never be cut, and the only benefits that can be adjusted down are those that were previously adjusted upward.

_______________

Endnotes

[1] Formally, the Wisconsin Department of Employee Trust Funds (ETF) administrates retirement benefits and related benefit programs. The Wisconsin Investment Board manages the assets. Meaning the staff at ETF have no control over investment decisions. When Conlin says they “couldn’t do a thing” to stop the 2008 losses, he means it figuratively about the markets as a whole, and literally about the governance structure of WRS.

[2] For details, see Why Funded Status Matters.

[3] The one caveat to this praise is that a 7% assumed rate of return is still significantly higher than what

federal regulations allow private sector pension plans to use. Using lower investment assumptions to account for WRS liabilities would mean that the system is not actually 100% funded, but perhaps closer to 90% funded (depending on what assumed rate of return is used). Nevertheless, if all public plans were to shift toward using assumed rates of return like private sector pensions, Wisconsin would still be ranked among the best funded plans in the country because everyone would be scaling down their reported funded status.

[4] Depending on the selections of an employee, their benefit may be completely based on the “Core Fund” or partially based on the “Variable Fund.” Benefits generated from both funds can earn variable Annuity Adjustments. There is a 5-year “smoothing” process for benefit adjustments in the Core Fund, with 20% of gains or losses recognized each year. All gains and losses are realized immediately for benefit adjustments to the Variable Fund.

[5] As of 2008, WRS reported that it had 265,721 active employees, 147,308 inactive but not yet retired participants, and 144,033 people receiving annuities (retirees, beneficiaries, or individuals receiving a disability pension).