It is important that public sector pension funds receive adequate contributions each year in order to maintain a healthy funded status, or make progress on a plan to recovery. And the minimum necessary step for a state or local government to make adequate payments is to ensure they are paying 100% of the “actuarially determined contribution” (ADC).

Part 1: Payments to Backfill a Funding Shortfall

When pension plans have a shortfall in the money that should be available to earn investment returns and pay benefits, this is called an unfunded liability. To backfill that shortfall, the government sponsoring a pension plan needs to make payments — either regular contributions each year, or lump sums. Or both.

Contributing money to a pension plan to backfill a shortfall in funding is known as an amortization payment. These payments are similar to setting up a schedule to pay off a mortgage. Pension boards set policies for how they want to pay down an unfunded liability — such as fixed dollar payments each year for 20 years — and then an actuary calculates how much needs to be contributed annually.[1]

Because pension benefits have been promised to public workers no matter the funded status of a pension fund, unfunded liabilities are effectively a debt that is owed by the government to the pension fund. That is why unfunded liabilities are sometimes called pension debt. And similar to paying off a mortgage or credit card, the longer pension funds take to pay off debt, the more interest will add up, and the more contributions will have to go up to pay for it.

Part 2: Normal Payments for Benefits Earned Each Year

Actuaries estimate the total value of pensions that are expected to be earned each year, using educated guesses about how long people will work, what their salaries will be, how long they will live, and other factors. Then, those finance specialists recommend an amount that should be paid into the pension fund for benefits that have been earned this year — factoring in what those contributions will earn in investments. This recommended contribution is known as “normal cost.”

Combining “Normal Cost” and “Pension Debt Payments”

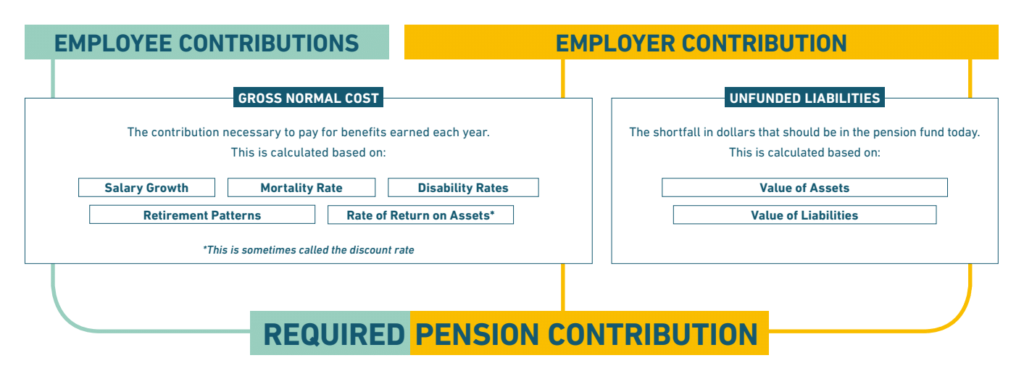

The annual, actuarially determined contribution rate is a combination of (1) normal cost for benefits earned during the same fiscal year, and (2) unfunded liability payments to backfill any funding shortfall that has occurred over time.

As the figure below shows, employee contributions typically are applied to normal cost first. Any remaining normal cost is paid for with employer contributions. Then employer contributions also go toward paying down the unfunded liability.[2]

The term “ADC” has emerged recently, over the past five years. For the decade before that, the combined total of normal cost and unfunded liability payments was sometimes called the “actuarially required contribution” or ARC payment.

In the balancing equation discussed earlier — B + E = C + I — the “C” is really the ADC, actuarially determined contribution. It is the amount necessary to pay benefits plus expenses, after accounting for an assumed investment return.

__________________

[1] Some pension funds have fixed contribution rates. The hope is that the fixed contribution rates are set close to the ADC, but often they fall short.

[2] Depending on how your state is structured, the employer share of the ADC might be paid for by the state directly, by a local employer — such as a municipality or school district — or a combination of the two.

This article is part of Equable’s Pension Basics series. To learn more about how your pension works, check out the other articles in the series:

1. How Pension Benefits Are Calculated

2. Vesting

3. The Pension Funding Formula

5. Normal Cost

6. Unfunded Liabilities (aka Pension Debt)

7. Actuarially Determined Contributions

10. Governance

11. Pension Myths & Facts: The Assumed Rate of Return Does Not Determine the Value of Benefits

12. Pension Myths & Facts: The Funded Status of Pension Plans Does Not Depend on More Public Employees