The Arizona State Retirement System provides benefits to more than a half-million members, including more than 100,000 retired members, according to its website. Here’s everything you need to know about the Grand Canyon State’s retirement system.

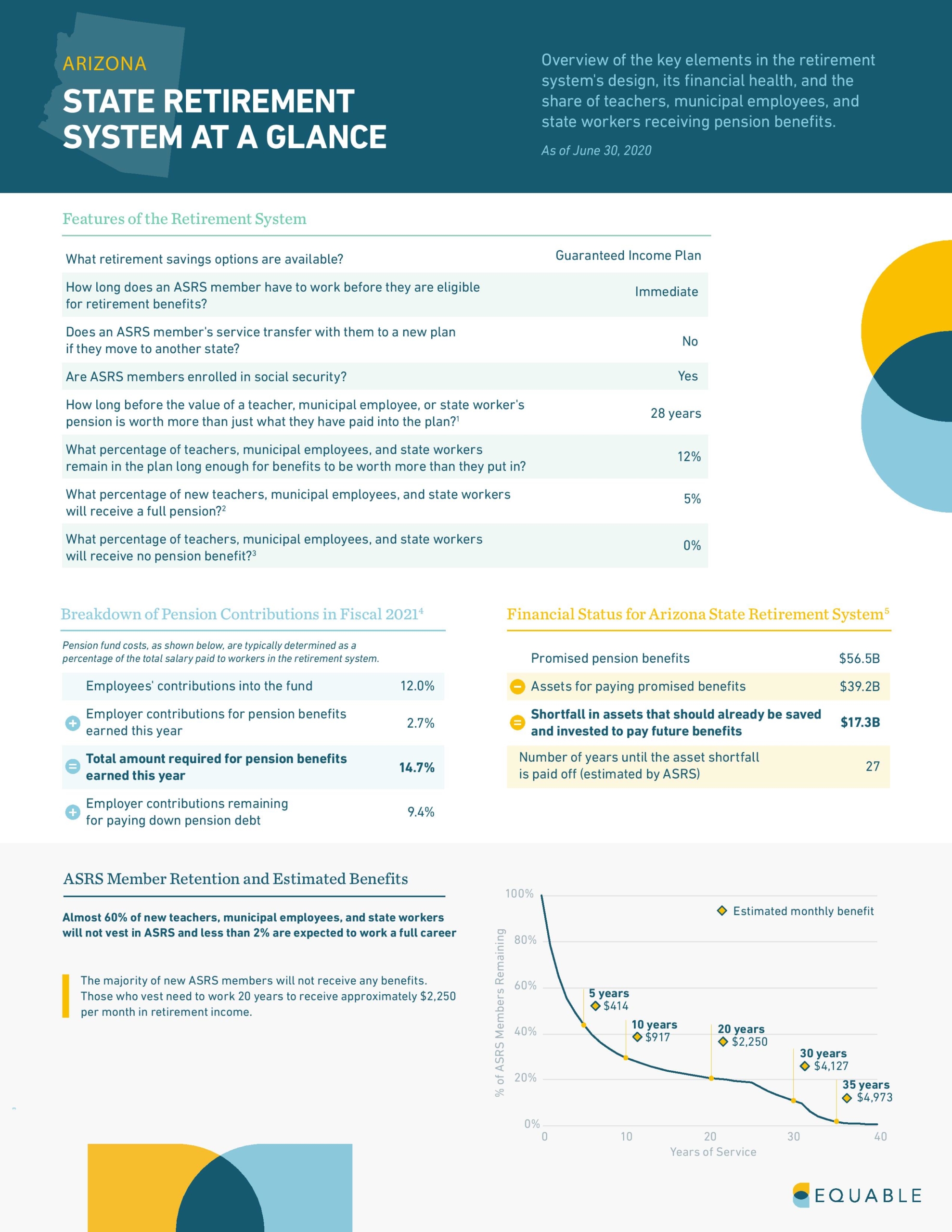

Right now, the Arizona State Retirement System offers its members a Guaranteed Income plan. Unlike many states’ plans, Arizona’s public workers don’t have a vesting period — meaning they’re eligible to gain the right to pension contributions from their employer upon enrolling in the system. However, benefits and refundable contributions available to members will vary depending on a member’s years of service.

Like most states, members are allowed to enroll in Social Security (some states bar public workers from joining Social Security due to Constitutional concerns).

It takes 28 years before a public worker’s pension is worth more than what they’ve paid into the plan. As of June 2020, only 12% of Arizona’s teachers and municipal workers ever reach that point and 5% ever receive a full pension, based on teacher retention assumptions provided by the retirement system.

Almost 60% of new teachers, municipal employees, and state workers will not vest in ASRS and less than 2% are expected to work a full career. The majority of new ASRS members will not receive any benefits. Those who vest need to work 20 years to receive approximately $2,250 per month in retirement income.

Arizona’s State Retirement System has a $17.3 billion pension funding shortfall, also called pension debt. Unless major funding improvements are enacted by the state’s legislature, it will take 27 years before ASRS closes its pension debt.

Download the report: Arizona State Retirement System at a Glance