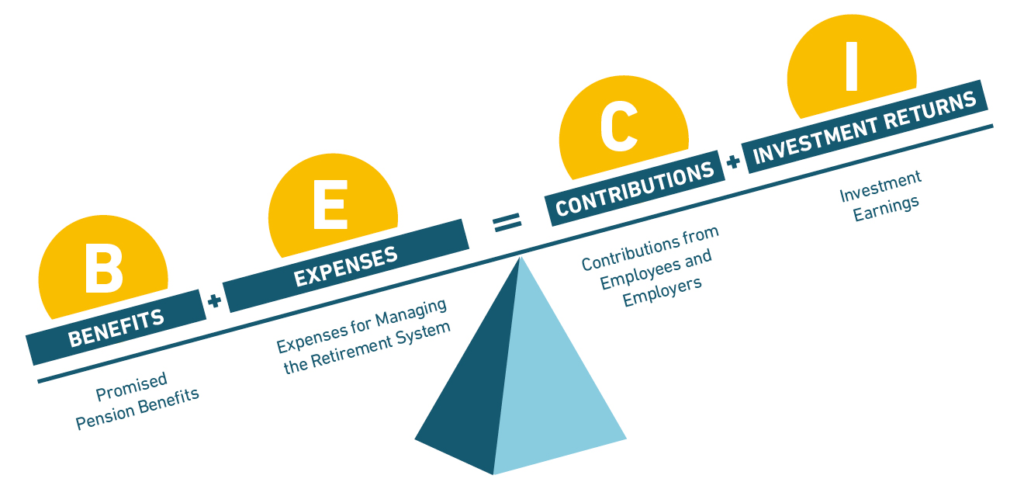

Pension plans are designed to collect contributions from active workers, invest that money to produce a return, and use those combined contributions and investment returns to pay promised benefits. This design means that when a pension plan is working as it should, the fund will hold assets equal to the estimated value of the benefits it has promised to pay.

Unlike Social Security, which uses money from today’s workers to pay today’s retirees and does not invest assets, pension funds should receive money today that can be invested to achieve the total needed to pay retirement benefits in the future.

When the value of assets fall below the value of benefits promised, then a pension fund has “unfunded liabilities.”

- The liability is the promise to pay benefits; it is a formal financial term that indicates both a moral and legal obligation to pay a promised retirement benefit. The pension plan and the government that created the pension plan is obligated to pay the benefits it has promised, thus those promises are liabilities.

- And when a pension fund has a shortfall in assets, there is an unfunded liability.

For example, if a pension fund has promised $1 billion in benefits to current retirees and working teachers, for instance, it should have $1 billion in assets. If that pension fund only has $900 million in assets, it has $100 million shortfall. This is kind of like the pension funding formula becoming imbalanced. Below are some real examples of unfunded liability levels for state and local pension funds.

This shortfall in pension funding — the unfunded liabilities — is money that is owed to the pension fund by the relevant state or local government. Employers make 'amortization' payments into the pension fund that are regular, additional contributions made until there is no more funding shortfall. This is similar to making mortgage payments that pay off debt on a house. Thus, sometimes, people call unfunded liabilities “pension debt.”

To find out what the unfunded liability is for pension funds in your state, visit My State Fact Cards.

CURRENT MODULE

Pension Basics

How Pension Benefits Are Calculated How Does Vesting Work? Understanding The Pension Funding Formula What is the Assumed Rate of Return? What is Normal Cost? Unfunded Liabilities (aka Pension Debt) What are Actuarially Determined Contributions? Paying the Pension Bill Funded Status Pension Fund Governance Pension Myths: The Assumed Rate of Return Does Not Determine the Value of Benefits Pension Myths: The Funded Status of Pension Plans Does Not Depend on More Public EmployeesNEXT MODULE

View all Modules

View all Modules