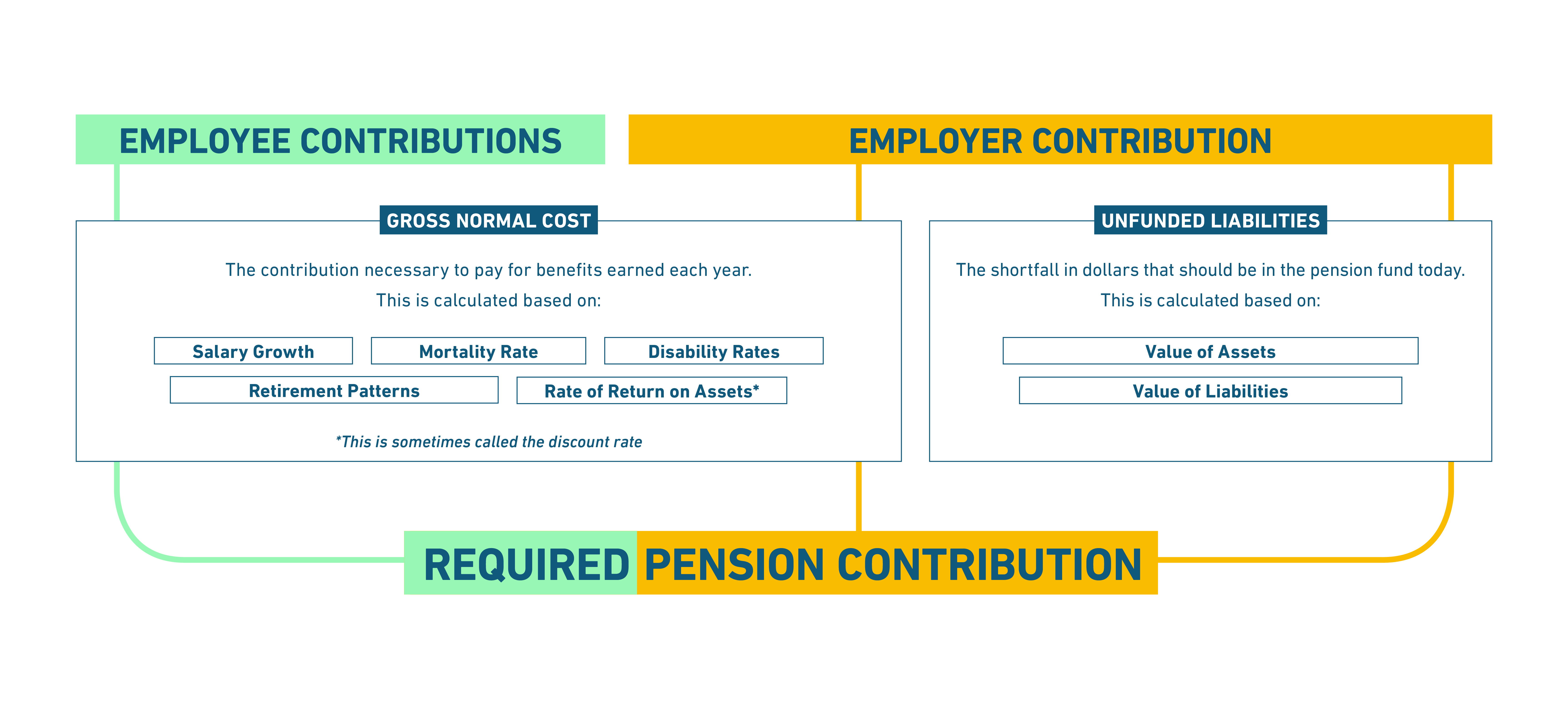

Normal cost is the contribution necessary, when added to investment income, to pay for benefits earned each year. The normal cost “prefunds” or “pays in advance” for promised pension benefits.

Normal cost is usually presented as a percentage of total salary earned by all teachers in the public pension system. This makes it easy to calculate the contribution rates for both members and their employers as a group.

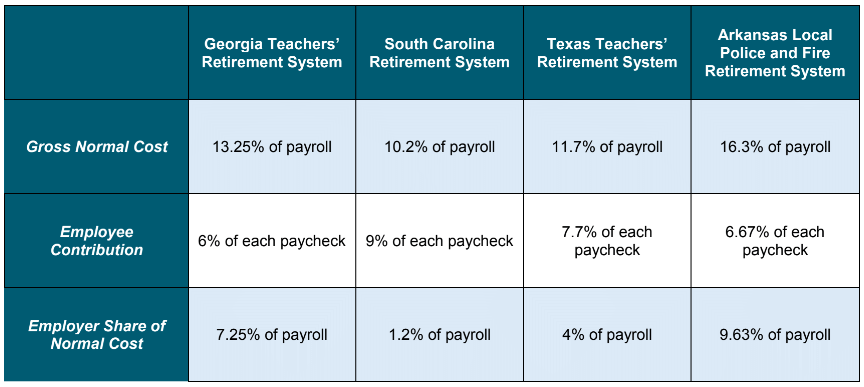

For example, suppose that when the actuaries got together to measure the payments necessary for your future pension, they determined 13.25% of your salary would be the appropriate amount—which is what Georgia’s actuaries estimate. Your state might require you to pay a portion of this—Georgia asks for 6%—while they would pick up the rest (in this case, 7.25%).

For example, suppose that when the actuaries got together to measure the payments necessary for your future pension, they determined 13.25% of your salary would be the appropriate amount—which is what Georgia’s actuaries estimate. Your state might require you to pay a portion of this—Georgia asks for 6%—while they would pick up the rest (in this case, 7.25%).

Typically, the amount of money taken out of each paycheck you receive for retirement benefits is the employee share of normal cost. Some pension systems also make payroll deductions for health care plans or retiree insurance plans.

In practice, the way that normal cost is paid for looks like this:

Example of How Normal Cost for Benefits Earned Each Year Gets Paid

Arkansas data is from fiscal year ending 2017. Georgia, South Carolina, And Texas figures are from fiscal year ending 2018, as reported by the state plans.

CURRENT MODULE

Pension Basics

How Pension Benefits Are Calculated How Does Vesting Work? Understanding The Pension Funding Formula What is the Assumed Rate of Return? What is Normal Cost? Unfunded Liabilities (aka Pension Debt) What are Actuarially Determined Contributions? Paying the Pension Bill Funded Status Pension Fund Governance Pension Myths: The Assumed Rate of Return Does Not Determine the Value of Benefits Pension Myths: The Funded Status of Pension Plans Does Not Depend on More Public EmployeesNEXT MODULE

View all Modules

View all Modules