The largest group affected by the Windfall Elimination Provision, or WEP, is state and local government employees who earn pensions from agencies that do not participate in Social Security (meeting the “pension” criteria), but that separately worked for more than 10 years at jobs with employers who did participate (meeting the “covered earnings” criteria).

State and Local Workers

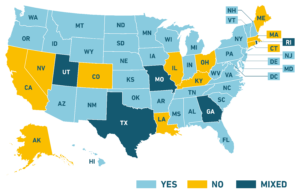

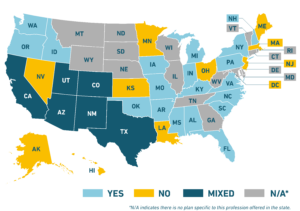

There are a few million public employees who might be affected by the WEP. This group of individuals includes a range of public sector jobs, from teachers, to librarians, to police officers and firefighters. They are concentrated in just a few states, though, because most state and local governments do participate in Social Security. See some examples of Social Security Coverage maps below.

Teachers and Public School Employees

Police Officers and Firefighters

A subset of individuals who are likely most negatively affected are those who just barely vest in their government employer-sponsored pension plan and have the minimum number of covered earnings credits to qualify for Social Security.

For example, imagine a person who (a) worked a small number of years prior to joining public service at a young age, then (b) worked a decade or less in public service (perhaps as a teacher) and qualify for a small pension, but then (c) left the workforce to take care of a family (perhaps to raise children or care for a relative). Such an individual might work just long enough over their lives to meet the covered earnings criteria, but the meager Social Security benefits they’d accrue would then be sharply reduced by the Windfall Elimination Provision because of the small pension benefit they’d have earned.

Rules for Beneficiaries and Survivors

The Windfall Elimination Provision applies to workers described above and the benefits for their eligible dependents. However, the WEP does not affect:

- Social Security spousal or widow(er) benefits.

- The Social Security benefits earned by a spouse from their own Social Security covered earnings.

This means that while the WEP might affect a worker’s Social Security by reducing their benefits during their lifetime, should that person die and pass on federal survivor benefits then those survivor benefits would be calculated as if the Windfall Elimination Provision didn’t exist.[1] However, a separate rule, called the Government Pension Offset may apply to survivor benefits instead. (See the next section.)

Exceptions to the Windfall Elimination Provision

The WEP does not apply to most workers, and there are several exceptions that allow individuals to avoid having their Social Security benefits reduced.

- The WEP does not apply to those with at least 30 years of covered earnings above a threshold the Social Security Administration deems “substantial” (see “How Does the WEP Work” for details on how “substantial” is defined). This means no matter how large your pension benefit is, if you have 30 or more years of Social Security covered earnings the WEP will not reduce your federal benefits.

- The WEP does not apply to individuals who were enrolled by their government employer in Social Security while also earning a pension benefit.

- The WEP does not affect federal employees hired after December 31, 1983, or workers whose sole pension is from railroad employment.

Learn more about the Windfall Elimination Provision here.

[1] See Social Security Administration, “Publication No. 05-10045,” January 2022.