The Windfall Elimination Provision, or WEP, affects workers who meet both of the following criteria.

The first criterion is having a “pension” without Social Security.

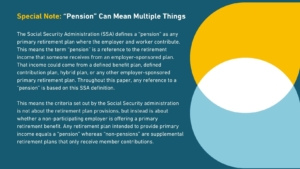

Under this criterion, a person must work long enough for a government employer that does not enroll all of its employees in Social Security to earn a retirement benefit provided by that employer. Usually, this retirement benefit will be a defined benefit pension plan, but it can also be a defined contribution plan that is intended to be a primary source of retirement income.

The Reason Why: If a public worker’s employer does not participate in Social Security, that means there are no taxes paid into the federal retirement program during their employment. Because the person does not pay the Social Security tax on their earnings from that employer, they do not earn Social Security benefits related to their time working in that position. Formally, the person’s time at that employer is called “non-covered employment,” and their wages are referred to as “non-covered earnings.”

The second criterion is having separate Social Security “covered earnings.”

Under this criterion, a person must work long enough for a different employer or group of employers that do participate and enroll all their employees in Social Security. This could be before and/or after time spent working for a government employer that does not participate in Social Security.

The Reason Why: Because the Social Security tax applies to earnings, workers receive credit toward Social Security benefits each time they get a paycheck that has Social Security taxes withheld.[1] The person’s time with these employers is called covered employment, and their wages there are referred to as covered earnings.

In short…

…to meet the two WEP criteria a worker will have to have spent considerable time with different employers, long enough to have earned a pension with a government employer that isn’t participating in Social Security, and long enough with a separate employer(s) that does participate in Social Security.